Email

#GoodPolicyGoodPolitics, Making Industrial Policy & Planning Inclusive, and Why Talking About Student Debt Means Talking About Power

| From | Felicia Wong, President & CEO <[email protected]> |

| Subject | #GoodPolicyGoodPolitics, Making Industrial Policy & Planning Inclusive, and Why Talking About Student Debt Means Talking About Power |

| Date | August 2, 2019 3:08 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View this in your browser and share with your friends. <[link removed]>

<[link removed]>

The Roosevelt Rundown is an email series featuring the Roosevelt Institute’s top 5 stories of the week.

1. #GoodPolicyGoodPolitics

Progressive policies <[link removed]> aren’t just good governance; they’re good politics, as Roosevelt President and CEO Felicia Wong argues in a blog post <[link removed]> about this week’s Democratic debates. The proof is in the polls <[link removed]>: Most Americans—and many Republicans <[link removed]>—support progressive economic priorities, such as taxing the wealthy and raising the minimum wage. They also favor reclaiming public power with the kinds of bold proposals that the moment demands, including across-the-board government investment in green jobs and infrastructure. “An aggressively progressive candidate can make the argument about real structural change to the economy with very little risk of backlash,” Wong writes.

2. Making Industrial Policy & Planning Comprehensive and Inclusive

Sustainable economic growth requires more than small-ball tariffs, as Roosevelt Fellow Todd Tucker argues in Industrial Policy and Planning: What It Is and How to Do It Better <[link removed]>. To create a better economy for all, the US must implement a holistic industrial plan <[link removed]> in the vein of a Green New Deal, rather than today’s ad hoc measures for preferred industries. On the blog, Roosevelt Communications Director Kendra Bozarth explores how institutional racism hinders American industrial policy and economic progress, underscoring why new rules must be inclusive <[link removed]>.

3. Ear to the Ground

On last week’s episode of Left, Right & Center <[link removed]>, Roosevelt’s Felicia Wong discusses Robert Mueller’s congressional hearing, the latest budget deal, and the increasingly progressive policy preferences of swing voters. Later in the podcast, Roosevelt Fellow JW Mason <[link removed]> joins the conversation to discuss his recent decarbonization report <[link removed]> (co-authored with Roosevelt Fellow Mark Paul and Anders Fremstad of Colorado State University). As Wong summarizes, “To really make the transition to a green economy—not just to ... phase out fossil fuels, but also to expand mass transit or to retrofit buildings or pay farmers to capture carbon—you simply must have a public investment-led strategy.”

4. When We Talk About Student Debt, We’re Talking About Power

Quoted in a MarketWatch <[link removed]> article about Sen. Kamala Harris’s (D-CA) new student-debt forgiveness proposal, Roosevelt Fellow Julie Margetta Morgan contrasts the varying scope of 2020 candidates’ approaches to the student debt crisis. In a Roosevelt blog post <[link removed]>, Margetta Morgan examines the structural dynamics of the debt spiral: stagnating wages <[link removed]> for college graduates, brazen profiteering in the loan industry, and a worsening racial wealth gap <[link removed]>. “Student debt is not only a tool in the erosion of public power, the accumulation of private power, and the entrenchment of racial inequality, but it is also a symbol of the overall power imbalances in our economy,” Margetta Morgan writes.

5.Empowering Workers, Not Corporations

“We desperately need a more racially inclusive and environmentally sustainable alternative to the post-neoliberal right,” Roosevelt Fellow Todd Tucker writes in a Nation <[link removed]> piece analyzing Sen. Elizabeth Warren’s (D-MA) just-released trade manifesto <[link removed]>. Building on Warrens’s proposals to curb Trumpian economic nationalism and center labor and environmental interests in trade, Tucker highlights the potential of rebuilding worker power and integrating a Green New Deal in our trade regime. In marshalling public power and putting people before corporate profits, he argues, Americans can rewrite the rules of trade to benefit all.

What We’re Reading

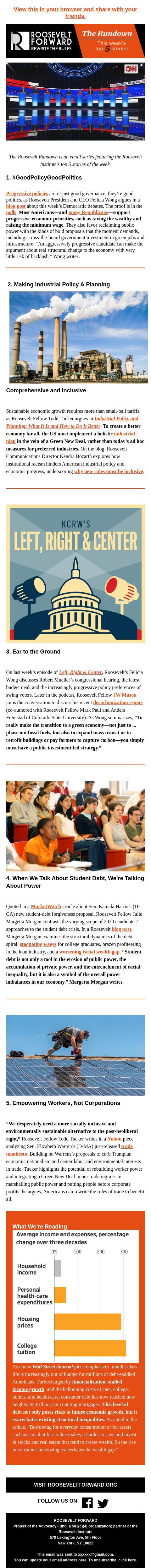

As a new Wall Street Journal <[link removed]> piece emphasizes, middle-class life is increasingly out of budget for millions of debt-saddled Americans. Turbocharged by financialization <[link removed]>; stalled income growth <[link removed]>; and the ballooning costs of cars, college, homes, and health care, consumer debt has now reached new heights: $4 trillion, not counting mortgages. This level of debt not only poses risks to future economic growth <[link removed]>, but it exacerbates existing structural inequalities. As noted in the article, “Borrowing for everyday consumption or for assets such as cars that lose value makes it harder to save and invest in stocks and real estate that tend to create wealth. So the rise in consumer borrowing exacerbates the wealth gap.”

-=-=-

Roosevelt Institute - United States

This email was sent to [email protected]. To stop receiving emails: [link removed]

-=-=-

Created with NationBuilder - [link removed]

<[link removed]>

The Roosevelt Rundown is an email series featuring the Roosevelt Institute’s top 5 stories of the week.

1. #GoodPolicyGoodPolitics

Progressive policies <[link removed]> aren’t just good governance; they’re good politics, as Roosevelt President and CEO Felicia Wong argues in a blog post <[link removed]> about this week’s Democratic debates. The proof is in the polls <[link removed]>: Most Americans—and many Republicans <[link removed]>—support progressive economic priorities, such as taxing the wealthy and raising the minimum wage. They also favor reclaiming public power with the kinds of bold proposals that the moment demands, including across-the-board government investment in green jobs and infrastructure. “An aggressively progressive candidate can make the argument about real structural change to the economy with very little risk of backlash,” Wong writes.

2. Making Industrial Policy & Planning Comprehensive and Inclusive

Sustainable economic growth requires more than small-ball tariffs, as Roosevelt Fellow Todd Tucker argues in Industrial Policy and Planning: What It Is and How to Do It Better <[link removed]>. To create a better economy for all, the US must implement a holistic industrial plan <[link removed]> in the vein of a Green New Deal, rather than today’s ad hoc measures for preferred industries. On the blog, Roosevelt Communications Director Kendra Bozarth explores how institutional racism hinders American industrial policy and economic progress, underscoring why new rules must be inclusive <[link removed]>.

3. Ear to the Ground

On last week’s episode of Left, Right & Center <[link removed]>, Roosevelt’s Felicia Wong discusses Robert Mueller’s congressional hearing, the latest budget deal, and the increasingly progressive policy preferences of swing voters. Later in the podcast, Roosevelt Fellow JW Mason <[link removed]> joins the conversation to discuss his recent decarbonization report <[link removed]> (co-authored with Roosevelt Fellow Mark Paul and Anders Fremstad of Colorado State University). As Wong summarizes, “To really make the transition to a green economy—not just to ... phase out fossil fuels, but also to expand mass transit or to retrofit buildings or pay farmers to capture carbon—you simply must have a public investment-led strategy.”

4. When We Talk About Student Debt, We’re Talking About Power

Quoted in a MarketWatch <[link removed]> article about Sen. Kamala Harris’s (D-CA) new student-debt forgiveness proposal, Roosevelt Fellow Julie Margetta Morgan contrasts the varying scope of 2020 candidates’ approaches to the student debt crisis. In a Roosevelt blog post <[link removed]>, Margetta Morgan examines the structural dynamics of the debt spiral: stagnating wages <[link removed]> for college graduates, brazen profiteering in the loan industry, and a worsening racial wealth gap <[link removed]>. “Student debt is not only a tool in the erosion of public power, the accumulation of private power, and the entrenchment of racial inequality, but it is also a symbol of the overall power imbalances in our economy,” Margetta Morgan writes.

5.Empowering Workers, Not Corporations

“We desperately need a more racially inclusive and environmentally sustainable alternative to the post-neoliberal right,” Roosevelt Fellow Todd Tucker writes in a Nation <[link removed]> piece analyzing Sen. Elizabeth Warren’s (D-MA) just-released trade manifesto <[link removed]>. Building on Warrens’s proposals to curb Trumpian economic nationalism and center labor and environmental interests in trade, Tucker highlights the potential of rebuilding worker power and integrating a Green New Deal in our trade regime. In marshalling public power and putting people before corporate profits, he argues, Americans can rewrite the rules of trade to benefit all.

What We’re Reading

As a new Wall Street Journal <[link removed]> piece emphasizes, middle-class life is increasingly out of budget for millions of debt-saddled Americans. Turbocharged by financialization <[link removed]>; stalled income growth <[link removed]>; and the ballooning costs of cars, college, homes, and health care, consumer debt has now reached new heights: $4 trillion, not counting mortgages. This level of debt not only poses risks to future economic growth <[link removed]>, but it exacerbates existing structural inequalities. As noted in the article, “Borrowing for everyday consumption or for assets such as cars that lose value makes it harder to save and invest in stocks and real estate that tend to create wealth. So the rise in consumer borrowing exacerbates the wealth gap.”

-=-=-

Roosevelt Institute - United States

This email was sent to [email protected]. To stop receiving emails: [link removed]

-=-=-

Created with NationBuilder - [link removed]

Message Analysis

- Sender: Roosevelt Institute

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- NationBuilder