Email

Governor Lamont Reaches Budget Agreement With Legislative Leaders That Includes the Largest Income Tax Cut in Connecticut History

| From | Governor Lamont's Office <[email protected]> |

| Subject | Governor Lamont Reaches Budget Agreement With Legislative Leaders That Includes the Largest Income Tax Cut in Connecticut History |

| Date | June 5, 2023 9:41 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Web Version [link removed]

Governor Lamont Reaches Budget Agreement With Legislative Leaders That Includes the Largest Income Tax Cut in Connecticut History [[link removed]]

Posted on June 5, 2023

(HARTFORD, CT) – Governor Ned Lamont today praised an agreement reached with the leadership of the Connecticut General Assembly on the state budget for Fiscal Year (FY) 2024 and FY 2025. This agreement includes the largest income tax cut for working and middle-class individuals and families in Connecticut history, provides significant increases in funding for K-12 and childcare programs, builds thousands of new housing units, and increases support for nonprofit providers. The General Assembly is expected to vote on this agreement prior to midnight on June 7.

“This budget will deliver the largest personal income tax cut in the state’s history,” Governor Lamont said. “This is not a temporary tax cut – it is designed to be sustainable for years to come. At the beginning of the legislative session, I promised that this budget would build growth and opportunity for all of Connecticut, and this agreement does just that. We are also making historic investments in K-12 education and housing – opening the door to homeownership for thousands of families and increasing funding for nonprofit service providers. I thank the leadership of the General Assembly for their assistance in crafting this transformational budget and I urge members to support it.”

“The broad-based middle-class tax relief included in this budget agreement is the direct result of the fiscal guardrails that have transformed our fiscal outlook over the last five years and that were extended earlier this session unanimously,” Office of Policy and Management Secretary Jeffrey Beckham said. “Governor Lamont has been clear about what he wanted to see in this budget – sustainable and broad-based tax cuts, adherence to the fiscal guardrails, and sustainability in the outyears. This budget accomplishes those goals, providing predictability and stability for essential services in future years.”

The agreement includes:

Tax Relief

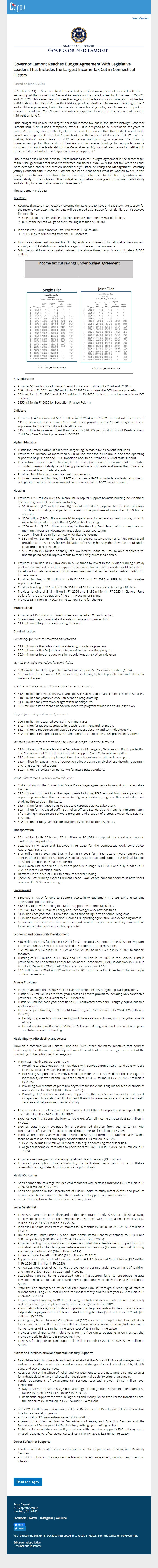

Reduces the state income tax by lowering the 5.0% rate to 4.5% and the 3.0% rate to 2.0% for the income year 2024. The benefits will be capped at $150,000 for single filers and $300,000 for joint filers. One million tax filers will benefit from the rate cuts – nearly 60% of all filers. 82% of the benefit will go to filers making less than $150,000. Increases the Earned Income Tax Credit from 30.5% to 40%. 211,000 filers will benefit from the EITC increase. Eliminates retirement income tax cliff by adding a phase-out for allowable pension and annuity and IRA distribution deductions against the Personal Income Tax. Total personal income tax relief between the above three items is approximately $460.3 million.

Income tax cut savings under budget agreement

Single Filer

Click image to enlarge

Joint Filer

Click image to enlarge

K-12 Education

Provides $25 million in additional Special Education funding in FY 2024 and FY 2025. $48 million in FY 2024 and $96 million in FY 2025 to continue the ECS formula phase-in. $6.6 million in FY 2024 and $13.2 million in FY 2025 to hold towns harmless from ECS declines. $150 million in FY 2025 for Education Finance Reform.

Childcare

Provides $14.2 million and $53.3 million in FY 2024 and FY 2025 to fund rate increases of 11% for licensed providers and 6% for unlicensed providers in the Care4Kids system. This is supplemented by a $35 million ARPA allocation. $15.5 million to increase Infant Pre-K rates to $10,500 per pupil in School Readiness and Child Day Care Contract programs in FY 2025.

Higher Education

Funds the state’s portion of collective bargaining increases for all constituent units. Provides an increase of more than $500 million over the biennium in one-time operating support to help UConn and CSCU transition back to a sustainable level of state support. Restructures fringe benefit funding to the constituent units to ensure that the state’s unfunded pension liability is not being passed on to students and make the universities more competitive for federal grants. Provides $6 million for student loan reimbursements. Includes permanent funding for PACT and expands PACT to include students returning to college after being previously enrolled. Increases minimum PACT award amount.

Housing

Provides $810 million over the biennium in capital support towards housing development and housing financial assistance, including: $150 million ($75 million annually) towards the state’s popular Time-To-Own program. This level of funding is expected to assist in the purchase of more than 1,250 homes annually. $200 million ($100 million annually) to expand workforce development housing, which is expected to provide an additional 2,000 units of housing. $200 million ($100 million annually) for the Housing Trust Fund, with an emphasis on multi-unit housing in downtown areas close to transportation. $200 million ($100 million annually) for flexible housing. $50 million ($25 million annually) for the Housing Receivership Fund. This funding will provide state resources for rehabilitation of existing housing that have been put under court ordered receivership. $10 million ($5 million annually) for low-interest loans to Time-To-Own recipients for unanticipated capital improvements to their newly purchased homes. Provides $2 million in FY 2024 only in ARPA funds to invest in the flexible funding subsidy pool of housing and homeless support to subsidize housing and provide flexible assistance to help individuals, families and youth overcome financial barriers and expedite solutions to homelessness. Provides funding of $1 million in both FY 2024 and FY 2025 in ARPA funds for housing support services. Provides funding of $10 million in FY 2024 in ARPA funds for various housing initiatives. Provides funding of $1.1 million in FY 2024 and $1.38 million in FY 2025 in General Fund dollars for the 24/7 operation of the 2-1-1 Housing Crisis line. Provides $5 million in FY 2024 in the General Fund for shelters.

Municipal Aid

Provides a $45 million combined increase in Tiered PILOT and Car Tax. Streamlines major municipal aid grants into one appropriated fund. $1.8 million to help fund early voting for towns.

Criminal Justice

Community gun violence prevention and reduction

$7.8 million for the public-health-centered gun violence program. $9.5 million for the Project Longevity gun violence reduction program. $5.0 million for housing vouchers for populations at risk of gun violence.

Services and added protections for crime victims

$33.2 million to fill the gap in federal Victims of Crime Act Assistance funding (ARPA). $6.7 million for enhanced GPS monitoring, including high-risk populations with domestic violence charges.

Investments in prevention and services for system-involved youth

$12.0 million for juvenile review boards to assess at-risk youth and connect them to services. $10.9 million for youth violence intervention programming. $14.6 million for prevention programs for at-risk youth. $0.3 million to implement a behavioral incentive program at Manson Youth Institution.

Support for court operations and personnel

$66.1 million for assigned counsel in criminal cases. $4.2 million for judges’ salaries to help with recruitment and retention. $1.3 million to modernize and upgrade courthouse security and technology (ARPA). $0.4 million for equipment to livestream Connecticut Supreme Court proceedings (ARPA).

Improved outcomes for the correction population or people with criminal records

$2.0 million for IT upgrades at the Department of Emergency Services and Public protection and Department of Correction personnel to support Clean Slate implementation. $1.2 million to continue implementation of no-charge inmate calls and messages. $1.0 million for Department of Correction pilot programs in alcohol-use-disorder treatment and long-acting medications. $0.9 million to increase compensation for incarcerated workers.

Support for emergency services and public safety

$34.9 million for the Connecticut State Police wage agreements to recruit and retain state troopers. $7.5 million to support local fire departments including PFAS removal from fire apparatuses, supporting volunteer fire responses to highway incidents, regional fire academies, and studying fire service in the state. $1.6 million for enhancements to the State Forensic Science Laboratory. $0.6 million for increased staffing at Police Officers Standards and Training, implementation of a training management software program, and creation of a cross-division data scientist position. $0.5 million for body cameras for Division of Criminal Justice inspectors

Transportation

$9.1 million in FY 2024 and $9.4 million in FY 2025 to expand bus service to support workforce transportation. $525,000 in FY 2024 and $575,000 in FY 2025 for the Connecticut Work Zone Safety Awareness Program. $4.6 million in FY 2024 and $4.8 million in FY 2025 for Infrastructure Investment Jobs Act (IIJA) Position Funding to support 206 positions to pursue and support IIJA federal funding (positions adopted in FY 2023 midterm). New Haven Line funded at 86% of pre-pandemic usage in FY 2024 and fully funded in FY 2025 to match ridership trends. Hartford Line funded at 100% to optimize federal funding. Shoreline East funding exceeds current usage – 44% of pre-pandemic service in both years, compared to 30% current usage.

Environment

$500,000 in ARPA funding to support accessibility equipment in state parks, expanding access and opportunities. $129,317 to provide funding for staff to support Environmental Justice. $413,606 to fund Bureau of Energy and Technology Policy new positions. $1 million each year for CTGrown for CTKids supporting Farm-to-School programs. $2 million from ARPA for Container Gardens, supporting agriculture, and expanding access. $3 million PFAS Removal – funding to support local fire departments as they remove PFAS foams and contamination from fire apparatus.

Economic and Community Development

$10 million in ARPA funding in FY 2024 for Connecticut’s Summer at the Museum Program, of this amount, $3.5 million is earmarked to support for-profit museums. $3.5 million in ARPA funds in FY 2024 and $2.625 million in ARPA funds in FY 2025 to support theatres. Funding of $1.5 million in FY 2024 and $2.5 million in FY 2025 in the General Fund is provided to the Connecticut Center for Advanced Technology (CCAT), in addition $500,000 in both FY 2024 and FY 2025 in ARPA funds is used to support CCAT. $4.5 million in FY 2024 and $2 million in FY 2025 is provided in ARPA funds for municipal outdoor recreation.

Private Providers

Provides an additional $206.6 million over the biennium to strengthen private providers. Funds $53.3 million in each fiscal year across all private providers, including DDS-contracted providers – roughly equivalent to a 2.5% increase. Funds $50 million each year specific to DDS-contracted providers – roughly equivalent to a 4.5% increase. Includes capital funding for Nonprofit Grant Program ($25 million in FY 2024, $25 million in FY 2025). Facility upgrades to improve health, workplace safety conditions, and strengthen quality of care. New dedicated position in the Office of Policy and Management will oversee the program and future rounds of funding.

Health Equity, Affordability, and Access

Through a combination of General Fund and ARPA, there are many initiatives that address health equity, healthcare affordability, and avoid loss of healthcare coverage as a result of the unwinding of the public health emergency.

Minimizes health care disruptions by: Providing targeted outreach to individuals with serious chronic health conditions who are losing Medicaid coverage ($1 million in ARPA). Increasing support for CoveredCT, which provides zero-cost, Medicaid-like coverage for individuals just over income limits for Medicaid ($11.7 million in FY 2024, $22.7 million in FY 2025). Providing two months of premium payments for individuals eligible for federal subsidies under Access Health CT ($10 million in ARPA). Providing $17 million in additional support to the state’s two financially distressed, independent hospitals (Day Kimball and Bristol) to preserve access to essential health services and help ensure financial viability. Erases hundreds of millions of dollars in medical debt that disproportionately impacts Black and Latino families ($6.5 million in ARPA). Expands HUSKY C income eligibility to 105% FPL, after all income disregards ($8.5 million in FY 2025). Extends state HUSKY coverage for undocumented children from age 12 to 15, with continuation of coverage for participants through age 18 ($3 million in FY 2025). Funds a comprehensive evaluation of Medicaid rates to inform future rate increases, with a focus on access barriers and equity considerations ($3 million in ARPA). FY 2025 includes $12 million in Medicaid to begin addressing rate disparities. Align adult complex care rates to pediatric rates ($600,000 in FY2024, $1.35 million in FY 2025). Provides one-time grants to Federally Qualified Health Centers ($32 million). Improves prescription drug affordability by facilitating participation in a multistate consortium to negotiate discounts on prescription drugs.

Health Outcomes

Adds periodontal coverage for Medicaid members with certain conditions ($0.4 million in FY 2024, $1.0 million in FY 2025) Adds one position in the Department of Public Health to study infant deaths and produce recommendations to improve health disparities as they pertain to maternal care. Adds Cytomegalovirus to the newborn screening panel.

Social Safety Net

Increases earned income disregard under Temporary Family Assistance (TFA), allowing families to keep more of their employment earnings without impacting eligibility ($1.2 million in FY 2024, $3.1 million in FY 2025). Increases TFA time limits from 21 months to 36 months ($230,000 in FY 2024, $1.2 million in FY 2025). Doubles asset limits under TFA and State Administered General Assistance to $6,000 and $500, respectively ($900,000 in FY 2024, $3.7 million in FY 2025). Provides funding to community action agencies to distribute flexible client support funds for individuals and families facing immediate economic hardship (for example, food, housing, and transportation costs) ($10 million in ARPA). Increases burial benefit to $1,800 ($1.2 million in FY 2025). Supports anticipated costs of federally-required 9-8-8 Suicide and Crisis Lifeline ($2.2 million in FY 2024, $3.1 million in FY 2025). Annualizes expansion of Family First prevention programs under Department of Children and Families ($377,500 in FY 2024 and FY 2025). Establishes nursing home specialized unit infrastructure fund to encourage in-state development of additional specialized services (bariatric, vent, dialysis beds) ($4 million in ARPA). Stabilizes and strengthens residential care homes (RCHs) through a rebasing of rates to current costs using 2022 cost reports, the most recently audited rate year ($5.2 million in FY 2024 and FY 2025). Provides capital funding to RCHs that are grandfathered into outdated health and safety codes to encourage compliance with current codes ($5 million in ARPA). Allows retroactive eligibility for state supplement to help residents with the costs of care and help stabilize payments for RCHs and rated housing facilities ($0.4 million in FY 2024, $0.5 million in FY 2025). Adds agency-based Personal Care Attendant (PCA) services as an option to allow individuals that choose not to self-direct to benefit from these services while remaining independent at home (savings of $12.3 million in FY 2024, cost of $3.1 million in FY 2025). Provides capital grants for mobile vans for the free clinics operating in Connecticut that provide mobile health care ($500,000 in ARPA). Increases funding for migrant support ($1 million in both FY 2024, FY 2025; $3.25 million in ARPA).

Autism and Intellectual/Developmental Disability Supports

Establishes lead planning role and dedicated staff at the Office of Policy and Management to review the continuum of autism services across state agencies and school districts, identify gaps, and coordinate services. Adds position at the Office of Policy and Management to coordinate programs and services for individuals who have intellectual or developmental disability other than autism. Funds Department of Developmental Services caseload growth ($44.0 million over biennium): Day services for over 900 age outs and high school graduates over the biennium ($7.3 million in FY 2024 and $17.5 million in FY 2025). Residential supports for over 188 age outs and Money Follows the Person transitions over the biennium ($5.8 million in FY 2024 and $13.4 million). Adds $21.1 million over biennium to address Department of Developmental Services waiting lists for residential programs. Adds a total of 320 new autism waiver slots by 2026. Augments transition services in Department of Aging and Disability Services and the Department of Developmental Services for youth aging out of high school. Stabilizes intermediate care facility providers with one-time support ($5.6 million) and a phased rebasing to reflect actual costs ($1.9 million FY 2024, $2.1 million FY 2025).

Senior Safety Net Supports

Funds a new dementia services coordinator at the Department of Aging and Disability Services. Adds $2.5 million in funding over the biennium to enhance elderly nutrition and meals on wheels.

Read on CT.gov [[link removed]]

State Capitol

210 Capitol Avenue

Hartford, CT 06106

Facebook [[link removed]] | Twitter [[link removed]] | Instagram [[link removed]] | YouTube [[link removed]]

[link removed] [link removed]

You're receiving this email because you opted in to receive notices from the Office of the Governor.

Edit your subscription [link removed]

Unsubscribe instantly [link removed]

Governor Lamont Reaches Budget Agreement With Legislative Leaders That Includes the Largest Income Tax Cut in Connecticut History [[link removed]]

Posted on June 5, 2023

(HARTFORD, CT) – Governor Ned Lamont today praised an agreement reached with the leadership of the Connecticut General Assembly on the state budget for Fiscal Year (FY) 2024 and FY 2025. This agreement includes the largest income tax cut for working and middle-class individuals and families in Connecticut history, provides significant increases in funding for K-12 and childcare programs, builds thousands of new housing units, and increases support for nonprofit providers. The General Assembly is expected to vote on this agreement prior to midnight on June 7.

“This budget will deliver the largest personal income tax cut in the state’s history,” Governor Lamont said. “This is not a temporary tax cut – it is designed to be sustainable for years to come. At the beginning of the legislative session, I promised that this budget would build growth and opportunity for all of Connecticut, and this agreement does just that. We are also making historic investments in K-12 education and housing – opening the door to homeownership for thousands of families and increasing funding for nonprofit service providers. I thank the leadership of the General Assembly for their assistance in crafting this transformational budget and I urge members to support it.”

“The broad-based middle-class tax relief included in this budget agreement is the direct result of the fiscal guardrails that have transformed our fiscal outlook over the last five years and that were extended earlier this session unanimously,” Office of Policy and Management Secretary Jeffrey Beckham said. “Governor Lamont has been clear about what he wanted to see in this budget – sustainable and broad-based tax cuts, adherence to the fiscal guardrails, and sustainability in the outyears. This budget accomplishes those goals, providing predictability and stability for essential services in future years.”

The agreement includes:

Tax Relief

Reduces the state income tax by lowering the 5.0% rate to 4.5% and the 3.0% rate to 2.0% for the income year 2024. The benefits will be capped at $150,000 for single filers and $300,000 for joint filers. One million tax filers will benefit from the rate cuts – nearly 60% of all filers. 82% of the benefit will go to filers making less than $150,000. Increases the Earned Income Tax Credit from 30.5% to 40%. 211,000 filers will benefit from the EITC increase. Eliminates retirement income tax cliff by adding a phase-out for allowable pension and annuity and IRA distribution deductions against the Personal Income Tax. Total personal income tax relief between the above three items is approximately $460.3 million.

Income tax cut savings under budget agreement

Single Filer

Click image to enlarge

Joint Filer

Click image to enlarge

K-12 Education

Provides $25 million in additional Special Education funding in FY 2024 and FY 2025. $48 million in FY 2024 and $96 million in FY 2025 to continue the ECS formula phase-in. $6.6 million in FY 2024 and $13.2 million in FY 2025 to hold towns harmless from ECS declines. $150 million in FY 2025 for Education Finance Reform.

Childcare

Provides $14.2 million and $53.3 million in FY 2024 and FY 2025 to fund rate increases of 11% for licensed providers and 6% for unlicensed providers in the Care4Kids system. This is supplemented by a $35 million ARPA allocation. $15.5 million to increase Infant Pre-K rates to $10,500 per pupil in School Readiness and Child Day Care Contract programs in FY 2025.

Higher Education

Funds the state’s portion of collective bargaining increases for all constituent units. Provides an increase of more than $500 million over the biennium in one-time operating support to help UConn and CSCU transition back to a sustainable level of state support. Restructures fringe benefit funding to the constituent units to ensure that the state’s unfunded pension liability is not being passed on to students and make the universities more competitive for federal grants. Provides $6 million for student loan reimbursements. Includes permanent funding for PACT and expands PACT to include students returning to college after being previously enrolled. Increases minimum PACT award amount.

Housing

Provides $810 million over the biennium in capital support towards housing development and housing financial assistance, including: $150 million ($75 million annually) towards the state’s popular Time-To-Own program. This level of funding is expected to assist in the purchase of more than 1,250 homes annually. $200 million ($100 million annually) to expand workforce development housing, which is expected to provide an additional 2,000 units of housing. $200 million ($100 million annually) for the Housing Trust Fund, with an emphasis on multi-unit housing in downtown areas close to transportation. $200 million ($100 million annually) for flexible housing. $50 million ($25 million annually) for the Housing Receivership Fund. This funding will provide state resources for rehabilitation of existing housing that have been put under court ordered receivership. $10 million ($5 million annually) for low-interest loans to Time-To-Own recipients for unanticipated capital improvements to their newly purchased homes. Provides $2 million in FY 2024 only in ARPA funds to invest in the flexible funding subsidy pool of housing and homeless support to subsidize housing and provide flexible assistance to help individuals, families and youth overcome financial barriers and expedite solutions to homelessness. Provides funding of $1 million in both FY 2024 and FY 2025 in ARPA funds for housing support services. Provides funding of $10 million in FY 2024 in ARPA funds for various housing initiatives. Provides funding of $1.1 million in FY 2024 and $1.38 million in FY 2025 in General Fund dollars for the 24/7 operation of the 2-1-1 Housing Crisis line. Provides $5 million in FY 2024 in the General Fund for shelters.

Municipal Aid

Provides a $45 million combined increase in Tiered PILOT and Car Tax. Streamlines major municipal aid grants into one appropriated fund. $1.8 million to help fund early voting for towns.

Criminal Justice

Community gun violence prevention and reduction

$7.8 million for the public-health-centered gun violence program. $9.5 million for the Project Longevity gun violence reduction program. $5.0 million for housing vouchers for populations at risk of gun violence.

Services and added protections for crime victims

$33.2 million to fill the gap in federal Victims of Crime Act Assistance funding (ARPA). $6.7 million for enhanced GPS monitoring, including high-risk populations with domestic violence charges.

Investments in prevention and services for system-involved youth

$12.0 million for juvenile review boards to assess at-risk youth and connect them to services. $10.9 million for youth violence intervention programming. $14.6 million for prevention programs for at-risk youth. $0.3 million to implement a behavioral incentive program at Manson Youth Institution.

Support for court operations and personnel

$66.1 million for assigned counsel in criminal cases. $4.2 million for judges’ salaries to help with recruitment and retention. $1.3 million to modernize and upgrade courthouse security and technology (ARPA). $0.4 million for equipment to livestream Connecticut Supreme Court proceedings (ARPA).

Improved outcomes for the correction population or people with criminal records

$2.0 million for IT upgrades at the Department of Emergency Services and Public protection and Department of Correction personnel to support Clean Slate implementation. $1.2 million to continue implementation of no-charge inmate calls and messages. $1.0 million for Department of Correction pilot programs in alcohol-use-disorder treatment and long-acting medications. $0.9 million to increase compensation for incarcerated workers.

Support for emergency services and public safety

$34.9 million for the Connecticut State Police wage agreements to recruit and retain state troopers. $7.5 million to support local fire departments including PFAS removal from fire apparatuses, supporting volunteer fire responses to highway incidents, regional fire academies, and studying fire service in the state. $1.6 million for enhancements to the State Forensic Science Laboratory. $0.6 million for increased staffing at Police Officers Standards and Training, implementation of a training management software program, and creation of a cross-division data scientist position. $0.5 million for body cameras for Division of Criminal Justice inspectors

Transportation

$9.1 million in FY 2024 and $9.4 million in FY 2025 to expand bus service to support workforce transportation. $525,000 in FY 2024 and $575,000 in FY 2025 for the Connecticut Work Zone Safety Awareness Program. $4.6 million in FY 2024 and $4.8 million in FY 2025 for Infrastructure Investment Jobs Act (IIJA) Position Funding to support 206 positions to pursue and support IIJA federal funding (positions adopted in FY 2023 midterm). New Haven Line funded at 86% of pre-pandemic usage in FY 2024 and fully funded in FY 2025 to match ridership trends. Hartford Line funded at 100% to optimize federal funding. Shoreline East funding exceeds current usage – 44% of pre-pandemic service in both years, compared to 30% current usage.

Environment

$500,000 in ARPA funding to support accessibility equipment in state parks, expanding access and opportunities. $129,317 to provide funding for staff to support Environmental Justice. $413,606 to fund Bureau of Energy and Technology Policy new positions. $1 million each year for CTGrown for CTKids supporting Farm-to-School programs. $2 million from ARPA for Container Gardens, supporting agriculture, and expanding access. $3 million PFAS Removal – funding to support local fire departments as they remove PFAS foams and contamination from fire apparatus.

Economic and Community Development

$10 million in ARPA funding in FY 2024 for Connecticut’s Summer at the Museum Program, of this amount, $3.5 million is earmarked to support for-profit museums. $3.5 million in ARPA funds in FY 2024 and $2.625 million in ARPA funds in FY 2025 to support theatres. Funding of $1.5 million in FY 2024 and $2.5 million in FY 2025 in the General Fund is provided to the Connecticut Center for Advanced Technology (CCAT), in addition $500,000 in both FY 2024 and FY 2025 in ARPA funds is used to support CCAT. $4.5 million in FY 2024 and $2 million in FY 2025 is provided in ARPA funds for municipal outdoor recreation.

Private Providers

Provides an additional $206.6 million over the biennium to strengthen private providers. Funds $53.3 million in each fiscal year across all private providers, including DDS-contracted providers – roughly equivalent to a 2.5% increase. Funds $50 million each year specific to DDS-contracted providers – roughly equivalent to a 4.5% increase. Includes capital funding for Nonprofit Grant Program ($25 million in FY 2024, $25 million in FY 2025). Facility upgrades to improve health, workplace safety conditions, and strengthen quality of care. New dedicated position in the Office of Policy and Management will oversee the program and future rounds of funding.

Health Equity, Affordability, and Access

Through a combination of General Fund and ARPA, there are many initiatives that address health equity, healthcare affordability, and avoid loss of healthcare coverage as a result of the unwinding of the public health emergency.

Minimizes health care disruptions by: Providing targeted outreach to individuals with serious chronic health conditions who are losing Medicaid coverage ($1 million in ARPA). Increasing support for CoveredCT, which provides zero-cost, Medicaid-like coverage for individuals just over income limits for Medicaid ($11.7 million in FY 2024, $22.7 million in FY 2025). Providing two months of premium payments for individuals eligible for federal subsidies under Access Health CT ($10 million in ARPA). Providing $17 million in additional support to the state’s two financially distressed, independent hospitals (Day Kimball and Bristol) to preserve access to essential health services and help ensure financial viability. Erases hundreds of millions of dollars in medical debt that disproportionately impacts Black and Latino families ($6.5 million in ARPA). Expands HUSKY C income eligibility to 105% FPL, after all income disregards ($8.5 million in FY 2025). Extends state HUSKY coverage for undocumented children from age 12 to 15, with continuation of coverage for participants through age 18 ($3 million in FY 2025). Funds a comprehensive evaluation of Medicaid rates to inform future rate increases, with a focus on access barriers and equity considerations ($3 million in ARPA). FY 2025 includes $12 million in Medicaid to begin addressing rate disparities. Align adult complex care rates to pediatric rates ($600,000 in FY2024, $1.35 million in FY 2025). Provides one-time grants to Federally Qualified Health Centers ($32 million). Improves prescription drug affordability by facilitating participation in a multistate consortium to negotiate discounts on prescription drugs.

Health Outcomes

Adds periodontal coverage for Medicaid members with certain conditions ($0.4 million in FY 2024, $1.0 million in FY 2025) Adds one position in the Department of Public Health to study infant deaths and produce recommendations to improve health disparities as they pertain to maternal care. Adds Cytomegalovirus to the newborn screening panel.

Social Safety Net

Increases earned income disregard under Temporary Family Assistance (TFA), allowing families to keep more of their employment earnings without impacting eligibility ($1.2 million in FY 2024, $3.1 million in FY 2025). Increases TFA time limits from 21 months to 36 months ($230,000 in FY 2024, $1.2 million in FY 2025). Doubles asset limits under TFA and State Administered General Assistance to $6,000 and $500, respectively ($900,000 in FY 2024, $3.7 million in FY 2025). Provides funding to community action agencies to distribute flexible client support funds for individuals and families facing immediate economic hardship (for example, food, housing, and transportation costs) ($10 million in ARPA). Increases burial benefit to $1,800 ($1.2 million in FY 2025). Supports anticipated costs of federally-required 9-8-8 Suicide and Crisis Lifeline ($2.2 million in FY 2024, $3.1 million in FY 2025). Annualizes expansion of Family First prevention programs under Department of Children and Families ($377,500 in FY 2024 and FY 2025). Establishes nursing home specialized unit infrastructure fund to encourage in-state development of additional specialized services (bariatric, vent, dialysis beds) ($4 million in ARPA). Stabilizes and strengthens residential care homes (RCHs) through a rebasing of rates to current costs using 2022 cost reports, the most recently audited rate year ($5.2 million in FY 2024 and FY 2025). Provides capital funding to RCHs that are grandfathered into outdated health and safety codes to encourage compliance with current codes ($5 million in ARPA). Allows retroactive eligibility for state supplement to help residents with the costs of care and help stabilize payments for RCHs and rated housing facilities ($0.4 million in FY 2024, $0.5 million in FY 2025). Adds agency-based Personal Care Attendant (PCA) services as an option to allow individuals that choose not to self-direct to benefit from these services while remaining independent at home (savings of $12.3 million in FY 2024, cost of $3.1 million in FY 2025). Provides capital grants for mobile vans for the free clinics operating in Connecticut that provide mobile health care ($500,000 in ARPA). Increases funding for migrant support ($1 million in both FY 2024, FY 2025; $3.25 million in ARPA).

Autism and Intellectual/Developmental Disability Supports

Establishes lead planning role and dedicated staff at the Office of Policy and Management to review the continuum of autism services across state agencies and school districts, identify gaps, and coordinate services. Adds position at the Office of Policy and Management to coordinate programs and services for individuals who have intellectual or developmental disability other than autism. Funds Department of Developmental Services caseload growth ($44.0 million over biennium): Day services for over 900 age outs and high school graduates over the biennium ($7.3 million in FY 2024 and $17.5 million in FY 2025). Residential supports for over 188 age outs and Money Follows the Person transitions over the biennium ($5.8 million in FY 2024 and $13.4 million). Adds $21.1 million over biennium to address Department of Developmental Services waiting lists for residential programs. Adds a total of 320 new autism waiver slots by 2026. Augments transition services in Department of Aging and Disability Services and the Department of Developmental Services for youth aging out of high school. Stabilizes intermediate care facility providers with one-time support ($5.6 million) and a phased rebasing to reflect actual costs ($1.9 million FY 2024, $2.1 million FY 2025).

Senior Safety Net Supports

Funds a new dementia services coordinator at the Department of Aging and Disability Services. Adds $2.5 million in funding over the biennium to enhance elderly nutrition and meals on wheels.

Read on CT.gov [[link removed]]

State Capitol

210 Capitol Avenue

Hartford, CT 06106

Facebook [[link removed]] | Twitter [[link removed]] | Instagram [[link removed]] | YouTube [[link removed]]

[link removed] [link removed]

You're receiving this email because you opted in to receive notices from the Office of the Governor.

Edit your subscription [link removed]

Unsubscribe instantly [link removed]

Message Analysis

- Sender: Ned Lamont

- Political Party: Democratic

- Country: United States

- State/Locality: Connecticut

- Office: State Governor

-

Email Providers:

- Campaign Monitor