| From | USAFacts <[email protected]> |

| Subject | New numbers on state crime rates |

| Date | May 31, 2023 1:36 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Plus, how much income are Americans spending on housing?

[link removed]

** How much do people spend on housing?

------------------------------------------------------------

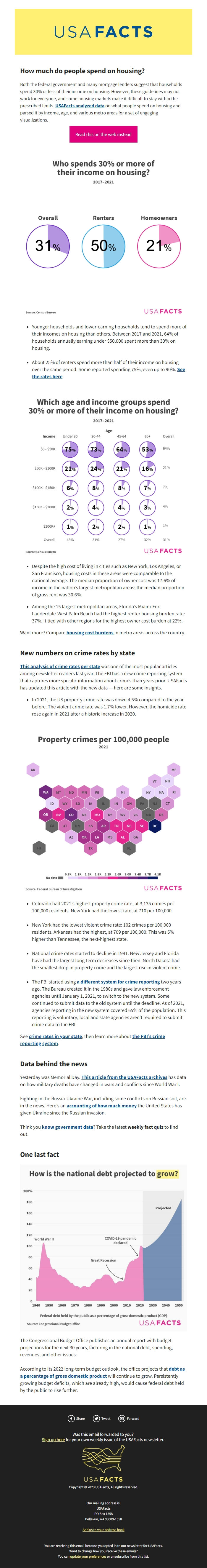

Both the federal government and many mortgage lenders suggest that households spend 30% or less of their income on housing. However, these guidelines may not work for everyone, and some housing markets make it difficult to stay within the prescribed limits. USAFacts analyzed data ([link removed]) on what people spend on housing and parsed it by income, age, and various metro areas for a set of engaging visualizations.

Read this on the web instead ([link removed])

[link removed]

* Younger households and lower-earning households tend to spend more of their incomes on housing than others. Between 2017 and 2021, 64% of households annually earning under $50,000 spent more than 30% on housing.

* About 25% of renters spend more than half of their income on housing over the same period. Some reported spending 75%, even up to 90%. See the rates here ([link removed]) .

[link removed]

* Despite the high cost of living in cities such as New York, Los Angeles, or San Francisco, housing costs in these areas were comparable to the national average. The median proportion of owner cost was 17.6% of income in the nation’s largest metropolitan areas; the median proportion of gross rent was 30.6%.

* Among the 15 largest metropolitan areas, Florida’s Miami-Fort Lauderdale-West Palm Beach had the highest renter housing burden rate: 37%. It tied with other regions for the highest owner cost burden at 22%.

Want more? Compare housing cost burdens ([link removed]) in metro areas across the country.

** New numbers on crime rates by state

------------------------------------------------------------

This analysis of crime rates per state ([link removed]) was one of the most popular articles among newsletter readers last year. The FBI has a new crime reporting system that captures more specific information about crimes than years prior. USAFacts has updated this article with the new data — here are some insights.

* In 2021, the US property crime rate was down 4.5% compared to the year before. The violent crime rate was 1.7% lower. However, the homicide rate rose again in 2021 after a historic increase in 2020.

[link removed]

* Colorado had 2021’s highest property crime rate, at 3,135 crimes per 100,000 residents. New York had the lowest rate, at 710 per 100,000.

* New York had the lowest violent crime rate: 102 crimes per 100,000 residents. Arkansas had the highest, at 709 per 100,000. This was 5% higher than Tennessee, the next-highest state.

* National crime rates started to decline in 1991. New Jersey and Florida have had the largest long-term decreases since then. North Dakota had the smallest drop in property crime and the largest rise in violent crime.

* The FBI started using a different system for crime reporting ([link removed]) two years ago. The Bureau created it in the 1980s and gave law enforcement agencies until January 1, 2021, to switch to the new system. Some continued to submit data to the old system until the deadline. As of 2021, agencies reporting in the new system covered 65% of the population. This reporting is voluntary; local and state agencies aren’t required to submit crime data to the FBI.

See crime rates in your state ([link removed]) , then learn more about the FBI’s crime reporting system ([link removed]) .

** Data behind the news

------------------------------------------------------------

Yesterday was Memorial Day. This article from the USAFacts archives ([link removed]) has data on how military deaths have changed in wars and conflicts since World War I.

Fighting in the Russia-Ukraine War, including some conflicts on Russian soil, are in the news. Here’s an accounting of how much money ([link removed]) the United States has given Ukraine since the Russian invasion.

Think you know government data ([link removed]) ? Take the latest weekly fact quiz to find out.

** One last fact

------------------------------------------------------------

[link removed]

The Congressional Budget Office publishes an annual report with budget projections for the next 30 years, factoring in the national debt, spending, revenues, and other issues.

According to its 2022 long-term budget outlook, the office projects that debt as a percentage of gross domestic product ([link removed]) will continue to grow. Persistently growing budget deficits, which are already high, would cause federal debt held by the public to rise further.

============================================================

** Share ([link removed])

** Share ([link removed])

** Tweet ([link removed] http%3A%2F%2Feepurl.com%2FismtNU)

** Tweet ([link removed] http%3A%2F%2Feepurl.com%2FismtNU)

** Forward ([link removed])

** Forward ([link removed])

Was this email forwarded to you?

** Sign up here ([link removed])

for your own weekly issue of the USAFacts newsletter.

** ([link removed])

Copyright © 2023 USAFacts, All rights reserved.

Our mailing address is:

USAFacts

PO Box 1558

Bellevue, WA 98009-1558

USA

You are receiving this email because you opted in to our newsletter for USAFacts.

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

[link removed]

** How much do people spend on housing?

------------------------------------------------------------

Both the federal government and many mortgage lenders suggest that households spend 30% or less of their income on housing. However, these guidelines may not work for everyone, and some housing markets make it difficult to stay within the prescribed limits. USAFacts analyzed data ([link removed]) on what people spend on housing and parsed it by income, age, and various metro areas for a set of engaging visualizations.

Read this on the web instead ([link removed])

[link removed]

* Younger households and lower-earning households tend to spend more of their incomes on housing than others. Between 2017 and 2021, 64% of households annually earning under $50,000 spent more than 30% on housing.

* About 25% of renters spend more than half of their income on housing over the same period. Some reported spending 75%, even up to 90%. See the rates here ([link removed]) .

[link removed]

* Despite the high cost of living in cities such as New York, Los Angeles, or San Francisco, housing costs in these areas were comparable to the national average. The median proportion of owner cost was 17.6% of income in the nation’s largest metropolitan areas; the median proportion of gross rent was 30.6%.

* Among the 15 largest metropolitan areas, Florida’s Miami-Fort Lauderdale-West Palm Beach had the highest renter housing burden rate: 37%. It tied with other regions for the highest owner cost burden at 22%.

Want more? Compare housing cost burdens ([link removed]) in metro areas across the country.

** New numbers on crime rates by state

------------------------------------------------------------

This analysis of crime rates per state ([link removed]) was one of the most popular articles among newsletter readers last year. The FBI has a new crime reporting system that captures more specific information about crimes than years prior. USAFacts has updated this article with the new data — here are some insights.

* In 2021, the US property crime rate was down 4.5% compared to the year before. The violent crime rate was 1.7% lower. However, the homicide rate rose again in 2021 after a historic increase in 2020.

[link removed]

* Colorado had 2021’s highest property crime rate, at 3,135 crimes per 100,000 residents. New York had the lowest rate, at 710 per 100,000.

* New York had the lowest violent crime rate: 102 crimes per 100,000 residents. Arkansas had the highest, at 709 per 100,000. This was 5% higher than Tennessee, the next-highest state.

* National crime rates started to decline in 1991. New Jersey and Florida have had the largest long-term decreases since then. North Dakota had the smallest drop in property crime and the largest rise in violent crime.

* The FBI started using a different system for crime reporting ([link removed]) two years ago. The Bureau created it in the 1980s and gave law enforcement agencies until January 1, 2021, to switch to the new system. Some continued to submit data to the old system until the deadline. As of 2021, agencies reporting in the new system covered 65% of the population. This reporting is voluntary; local and state agencies aren’t required to submit crime data to the FBI.

See crime rates in your state ([link removed]) , then learn more about the FBI’s crime reporting system ([link removed]) .

** Data behind the news

------------------------------------------------------------

Yesterday was Memorial Day. This article from the USAFacts archives ([link removed]) has data on how military deaths have changed in wars and conflicts since World War I.

Fighting in the Russia-Ukraine War, including some conflicts on Russian soil, are in the news. Here’s an accounting of how much money ([link removed]) the United States has given Ukraine since the Russian invasion.

Think you know government data ([link removed]) ? Take the latest weekly fact quiz to find out.

** One last fact

------------------------------------------------------------

[link removed]

The Congressional Budget Office publishes an annual report with budget projections for the next 30 years, factoring in the national debt, spending, revenues, and other issues.

According to its 2022 long-term budget outlook, the office projects that debt as a percentage of gross domestic product ([link removed]) will continue to grow. Persistently growing budget deficits, which are already high, would cause federal debt held by the public to rise further.

============================================================

** Share ([link removed])

** Share ([link removed])

** Tweet ([link removed] http%3A%2F%2Feepurl.com%2FismtNU)

** Tweet ([link removed] http%3A%2F%2Feepurl.com%2FismtNU)

** Forward ([link removed])

** Forward ([link removed])

Was this email forwarded to you?

** Sign up here ([link removed])

for your own weekly issue of the USAFacts newsletter.

** ([link removed])

Copyright © 2023 USAFacts, All rights reserved.

Our mailing address is:

USAFacts

PO Box 1558

Bellevue, WA 98009-1558

USA

You are receiving this email because you opted in to our newsletter for USAFacts.

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Message Analysis

- Sender: USAFacts

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp