Email

Update on direct tax rebate payments and the 2023 legislative session

| From | Minnesota Department of Revenue <[email protected]> |

| Subject | Update on direct tax rebate payments and the 2023 legislative session |

| Date | May 24, 2023 6:06 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

General header

Today, Governor Tim Walz signed legislation that directs the Minnesota Department of Revenue to distribute direct tax rebate payments. These payments are:

* $520 for married joint filers who had a 2021 adjusted gross income of $150,000 or less

* $260 for all other filers who had a 2021 adjusted gross income of $75,000 or less

* An additional $260 per dependent, up to three dependents, for filers who had a 2021 adjusted gross income at or below the thresholds above

You do not have to apply for this payment. Revenue will use tax year 2021 individual income tax or 2021 property tax refund returns to determine eligibility and distribute these tax rebate payments. We will reduce rebate amounts for part-year residents based on the percentage of the year they lived in Minnesota. We anticipate sending out these payments in early fall.

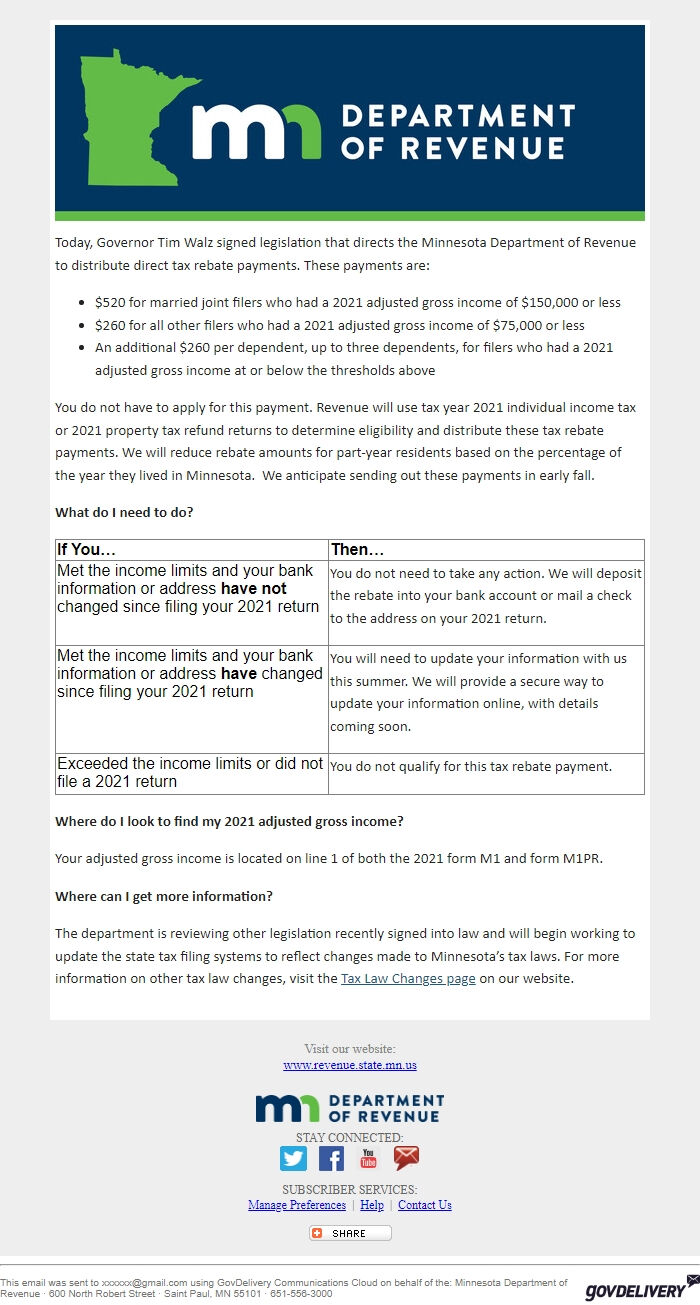

*What do I need to do?*

*If You…* *Then…* Met the income limits and your bank information or address *have not* changed since filing your 2021 return

You do not need to take any action. We will deposit the rebate into your bank account or mail a check to the address on your 2021 return.

Met the income limits and your bank information or address *have* changed since filing your 2021 return

You will need to update your information with us this summer. We will provide a secure way to update your information online, with details coming soon.

Exceeded the income limits or did not file a 2021 return

You do not qualify for this tax rebate payment.

*Where do I look to find my 2021 adjusted gross income?*

Your adjusted gross income is located on line 1 of both the 2021 form M1 and form M1PR.

*Where can I get more information?*

The department is reviewing other legislation recently signed into law and will begin working to update the state tax filing systems to reflect changes made to Minnesota’s tax laws. For more information on other tax law changes, visit the Tax Law Changes page [ [link removed] ] on our website.

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ] | Help [ [link removed] ] | Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue · 600 North Robert Street · Saint Paul, MN 55101 · 651-556-3000 GovDelivery logo [ [link removed] ]

Today, Governor Tim Walz signed legislation that directs the Minnesota Department of Revenue to distribute direct tax rebate payments. These payments are:

* $520 for married joint filers who had a 2021 adjusted gross income of $150,000 or less

* $260 for all other filers who had a 2021 adjusted gross income of $75,000 or less

* An additional $260 per dependent, up to three dependents, for filers who had a 2021 adjusted gross income at or below the thresholds above

You do not have to apply for this payment. Revenue will use tax year 2021 individual income tax or 2021 property tax refund returns to determine eligibility and distribute these tax rebate payments. We will reduce rebate amounts for part-year residents based on the percentage of the year they lived in Minnesota. We anticipate sending out these payments in early fall.

*What do I need to do?*

*If You…* *Then…* Met the income limits and your bank information or address *have not* changed since filing your 2021 return

You do not need to take any action. We will deposit the rebate into your bank account or mail a check to the address on your 2021 return.

Met the income limits and your bank information or address *have* changed since filing your 2021 return

You will need to update your information with us this summer. We will provide a secure way to update your information online, with details coming soon.

Exceeded the income limits or did not file a 2021 return

You do not qualify for this tax rebate payment.

*Where do I look to find my 2021 adjusted gross income?*

Your adjusted gross income is located on line 1 of both the 2021 form M1 and form M1PR.

*Where can I get more information?*

The department is reviewing other legislation recently signed into law and will begin working to update the state tax filing systems to reflect changes made to Minnesota’s tax laws. For more information on other tax law changes, visit the Tax Law Changes page [ [link removed] ] on our website.

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ] | Help [ [link removed] ] | Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue · 600 North Robert Street · Saint Paul, MN 55101 · 651-556-3000 GovDelivery logo [ [link removed] ]

Message Analysis

- Sender: Minnesota Department of Revenue

- Political Party: n/a

- Country: United States

- State/Locality: Minnesota

- Office: n/a

-

Email Providers:

- govDelivery