Email

[NEWS RELEASE] Administration, Fiscal Agencies Reach Consensus on Revenue Estimates

| From | Michigan Department of Treasury <[email protected]> |

| Subject | [NEWS RELEASE] Administration, Fiscal Agencies Reach Consensus on Revenue Estimates |

| Date | May 19, 2023 6:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

May Revenues Reflect Sustainable Tax Relief for Seniors, Working Families; Corporate Income Tax Exceeds Expectations

Treasury Logo

*FOR IMMEDIATE RELEASE

May 19, 2023*

*Contact:?Ron Leix <[email protected]>, Treasury, 517-335-2167*

Administration, Fiscal Agencies Reach Consensus on Revenue Estimates

"May Revenues Reflect Sustainable Tax Relief for Seniors, Working Families; Corporate Income Tax Exceeds Expectations "

LANSING, Mich. ? State Treasurer Rachael Eubanks, Senate Fiscal Agency Director Kathryn Summers and House Fiscal Agency Director Mary Ann Cleary today reached consensus on revised economic and revenue figures for the remainder of Fiscal Year (FY) 2023 and for the upcoming 2024 and 2025 fiscal years.

?Michigan?s economy continues to show signs of growth and resilience,? *State Treasurer Rachael Eubanks* said. ?Today?s revenue forecast reflects the tax relief recently provided to retirees and working families. Strong revenue growth has allowed us to provide sustainable tax revenue relief while also maintaining and investing in critical programs to create an environment where individuals and businesses can thrive.?

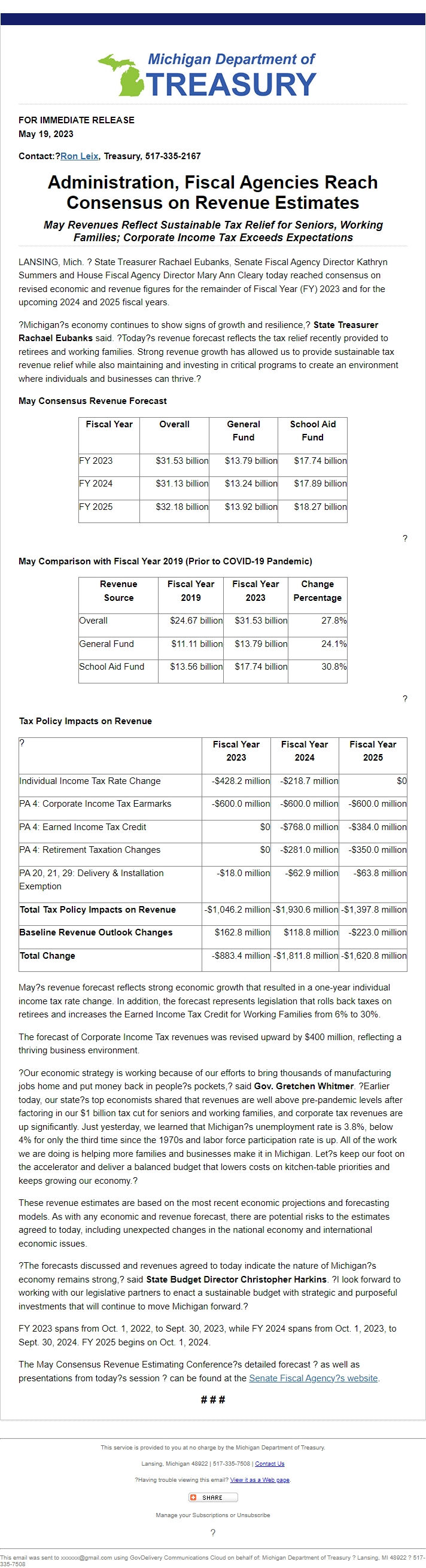

*May Consensus Revenue Forecast*

*Fiscal Year*

*Overall*

*General

Fund*

*School Aid

Fund*

FY 2023

$31.53 billion

$13.79 billion

$17.74 billion

FY 2024

$31.13 billion

$13.24 billion

$17.89 billion

FY 2025

$32.18 billion

$13.92 billion

$18.27 billion

?

*May Comparison with Fiscal Year 2019 (Prior to COVID-19 Pandemic)*

*Revenue

Source*

*Fiscal Year

2019*

*Fiscal Year

2023*

*Change

Percentage*

Overall

$24.67 billion

$31.53 billion

27.8%

General Fund

$11.11 billion

$13.79 billion

24.1%

School Aid Fund

$13.56 billion

$17.74 billion

30.8%

?

*Tax Policy Impacts on Revenue*

?

*Fiscal Year 2023*

*Fiscal Year 2024*

*Fiscal Year 2025*

Individual Income Tax Rate Change

-$428.2 million

-$218.7 million

$0

PA 4: Corporate Income Tax Earmarks

-$600.0 million

-$600.0 million

-$600.0 million

PA 4: Earned Income Tax Credit

$0

-$768.0 million

-$384.0 million

PA 4: Retirement Taxation Changes

$0

-$281.0 million

-$350.0 million

PA 20, 21, 29: Delivery & Installation Exemption

-$18.0 million

-$62.9 million

-$63.8 million

*Total Tax Policy Impacts on Revenue*

-$1,046.2 million

-$1,930.6 million

-$1,397.8 million

*Baseline Revenue Outlook Changes*

$162.8 million

$118.8 million

-$223.0 million

*Total Change*

-$883.4 million

-$1,811.8 million

-$1,620.8 million

May?s revenue forecast reflects strong economic growth that resulted in a one-year individual income tax rate change. In addition, the forecast represents legislation that rolls back taxes on retirees and increases the Earned Income Tax Credit for Working Families from 6% to 30%.

The forecast of Corporate Income Tax revenues was revised upward by $400 million, reflecting a thriving business environment.

?Our economic strategy is working because of our efforts to bring thousands of manufacturing jobs home and put money back in people?s pockets,? said *Gov. Gretchen Whitmer*. ?Earlier today, our state?s top economists shared that revenues are well above pre-pandemic levels after factoring in our $1 billion tax cut for seniors and working families, and corporate tax revenues are up significantly. Just yesterday, we learned that Michigan?s unemployment rate is 3.8%, below 4% for only the third time since the 1970s and labor force participation rate is up. All of the work we are doing is helping more families and businesses make it in Michigan. Let?s keep our foot on the accelerator and deliver a balanced budget that lowers costs on kitchen-table priorities and keeps growing our economy.?

These revenue estimates are based on the most recent economic projections and forecasting models. As with any economic and revenue forecast, there are potential risks to the estimates agreed to today, including unexpected changes in the national economy and international economic issues.

?The forecasts discussed and revenues agreed to today indicate the nature of Michigan?s economy remains strong,? said *State Budget Director Christopher Harkins*. ?I look forward to working with our legislative partners to enact a sustainable budget with strategic and purposeful investments that will continue to move Michigan forward.?

FY 2023 spans from Oct. 1, 2022, to Sept. 30, 2023, while FY 2024 spans from Oct. 1, 2023, to Sept. 30, 2024. FY 2025 begins on Oct. 1, 2024.

The May Consensus Revenue Estimating Conference?s detailed forecast ? as well as presentations from today?s session ? can be found at the Senate Fiscal Agency?s website [ [link removed] ].

# # #

________________________________________________________________________

This service is provided to you at no charge by the Michigan Department of Treasury.

Lansing, Michigan 48922 | 517-335-7508 | Contact Us [ [link removed] ]

?Having trouble viewing this email? View it as a Web page [ [link removed] ].

Bookmark and Share [ [link removed] ]

Manage your Subscriptions or Unsubscribe [ [link removed] ]

?

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of: Michigan Department of Treasury ? Lansing, MI 48922 ? 517-335-7508

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Treasury Logo

*FOR IMMEDIATE RELEASE

May 19, 2023*

*Contact:?Ron Leix <[email protected]>, Treasury, 517-335-2167*

Administration, Fiscal Agencies Reach Consensus on Revenue Estimates

"May Revenues Reflect Sustainable Tax Relief for Seniors, Working Families; Corporate Income Tax Exceeds Expectations "

LANSING, Mich. ? State Treasurer Rachael Eubanks, Senate Fiscal Agency Director Kathryn Summers and House Fiscal Agency Director Mary Ann Cleary today reached consensus on revised economic and revenue figures for the remainder of Fiscal Year (FY) 2023 and for the upcoming 2024 and 2025 fiscal years.

?Michigan?s economy continues to show signs of growth and resilience,? *State Treasurer Rachael Eubanks* said. ?Today?s revenue forecast reflects the tax relief recently provided to retirees and working families. Strong revenue growth has allowed us to provide sustainable tax revenue relief while also maintaining and investing in critical programs to create an environment where individuals and businesses can thrive.?

*May Consensus Revenue Forecast*

*Fiscal Year*

*Overall*

*General

Fund*

*School Aid

Fund*

FY 2023

$31.53 billion

$13.79 billion

$17.74 billion

FY 2024

$31.13 billion

$13.24 billion

$17.89 billion

FY 2025

$32.18 billion

$13.92 billion

$18.27 billion

?

*May Comparison with Fiscal Year 2019 (Prior to COVID-19 Pandemic)*

*Revenue

Source*

*Fiscal Year

2019*

*Fiscal Year

2023*

*Change

Percentage*

Overall

$24.67 billion

$31.53 billion

27.8%

General Fund

$11.11 billion

$13.79 billion

24.1%

School Aid Fund

$13.56 billion

$17.74 billion

30.8%

?

*Tax Policy Impacts on Revenue*

?

*Fiscal Year 2023*

*Fiscal Year 2024*

*Fiscal Year 2025*

Individual Income Tax Rate Change

-$428.2 million

-$218.7 million

$0

PA 4: Corporate Income Tax Earmarks

-$600.0 million

-$600.0 million

-$600.0 million

PA 4: Earned Income Tax Credit

$0

-$768.0 million

-$384.0 million

PA 4: Retirement Taxation Changes

$0

-$281.0 million

-$350.0 million

PA 20, 21, 29: Delivery & Installation Exemption

-$18.0 million

-$62.9 million

-$63.8 million

*Total Tax Policy Impacts on Revenue*

-$1,046.2 million

-$1,930.6 million

-$1,397.8 million

*Baseline Revenue Outlook Changes*

$162.8 million

$118.8 million

-$223.0 million

*Total Change*

-$883.4 million

-$1,811.8 million

-$1,620.8 million

May?s revenue forecast reflects strong economic growth that resulted in a one-year individual income tax rate change. In addition, the forecast represents legislation that rolls back taxes on retirees and increases the Earned Income Tax Credit for Working Families from 6% to 30%.

The forecast of Corporate Income Tax revenues was revised upward by $400 million, reflecting a thriving business environment.

?Our economic strategy is working because of our efforts to bring thousands of manufacturing jobs home and put money back in people?s pockets,? said *Gov. Gretchen Whitmer*. ?Earlier today, our state?s top economists shared that revenues are well above pre-pandemic levels after factoring in our $1 billion tax cut for seniors and working families, and corporate tax revenues are up significantly. Just yesterday, we learned that Michigan?s unemployment rate is 3.8%, below 4% for only the third time since the 1970s and labor force participation rate is up. All of the work we are doing is helping more families and businesses make it in Michigan. Let?s keep our foot on the accelerator and deliver a balanced budget that lowers costs on kitchen-table priorities and keeps growing our economy.?

These revenue estimates are based on the most recent economic projections and forecasting models. As with any economic and revenue forecast, there are potential risks to the estimates agreed to today, including unexpected changes in the national economy and international economic issues.

?The forecasts discussed and revenues agreed to today indicate the nature of Michigan?s economy remains strong,? said *State Budget Director Christopher Harkins*. ?I look forward to working with our legislative partners to enact a sustainable budget with strategic and purposeful investments that will continue to move Michigan forward.?

FY 2023 spans from Oct. 1, 2022, to Sept. 30, 2023, while FY 2024 spans from Oct. 1, 2023, to Sept. 30, 2024. FY 2025 begins on Oct. 1, 2024.

The May Consensus Revenue Estimating Conference?s detailed forecast ? as well as presentations from today?s session ? can be found at the Senate Fiscal Agency?s website [ [link removed] ].

# # #

________________________________________________________________________

This service is provided to you at no charge by the Michigan Department of Treasury.

Lansing, Michigan 48922 | 517-335-7508 | Contact Us [ [link removed] ]

?Having trouble viewing this email? View it as a Web page [ [link removed] ].

Bookmark and Share [ [link removed] ]

Manage your Subscriptions or Unsubscribe [ [link removed] ]

?

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of: Michigan Department of Treasury ? Lansing, MI 48922 ? 517-335-7508

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Message Analysis

- Sender: Michigan Department of Treasury

- Political Party: n/a

- Country: United States

- State/Locality: MIchigan

- Office: n/a

-

Email Providers:

- govDelivery