May 18, 2023

Permission to republish original opeds and cartoons granted.

Kevin McCarthy is right, ‘it's not a revenue problem, it's a spending problem’ after more than $6 trillion printed, borrowed and spent for Covid

By Robert Romano

“[I]t's not a revenue problem, it's a spending problem.”

That was House Speaker Kevin McCarthy (R-Calif.) speaking to reporters on May 17 following a meeting with President Joe Biden and Congressional leaders in both parties, attempting to reach an agreement on increasing the $31.4 trillion debt ceiling and budget spending levels, outlining the unsustainable trajectory of federal spending despite near-record-setting revenue levels.

“We have now borrowed more than a trillion dollars this year; that's the fastest we've ever accumulated that much debt that quickly. How much is too much? When are you going to look at for the American public that we're spending more than we've ever spent in history but on an average in more than 50 years? We're much higher than we ever [have been]. At the same time we're bringing more money into government than at any time in history,” McCarthy explained.

In addition, McCarthy noted the nation had “added six trillion dollars that created inflation.” And while he unsurprisingly blamed Democrats for the additional spending in 2021 as the severity of the Covid pandemic was waning, there was also plenty of spending in 2020 under former President Donald Trump, too, when the budget deficit hit an all-time high of $3.1 trillion as revenues stalled and spending ballooned amid the economic lockdowns.

It’s fair to say we got here on a bipartisan basis, and to navigate it will ultimately, barring either party gaining supermajorities in upcoming elections to overcome a Senate filibuster, also have to be done on a bipartisan basis.

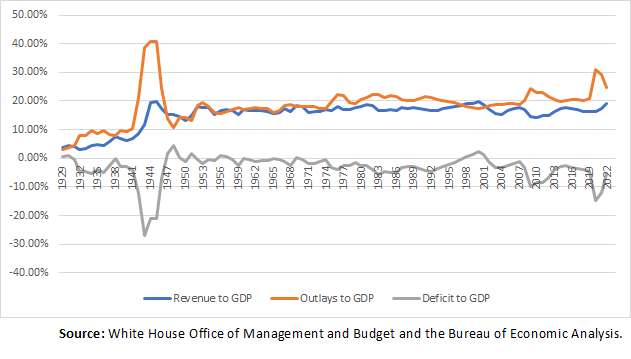

But on the overall point, McCarthy is right. Since 1929, as a percentage of the nation’s Gross Domestic Product (GDP) measured by the Bureau of Economic Analysis, federal spending outlays are the highest they’ve been since World War II, when all of the nation’s resources were being marshalled in the war effort to defeat the Axis Powers and liberate Europe and Asia.

In 2022, at $6.27 trillion of spending, according to President Joe Biden’s White House Office of Management and Budget (OMB), that is 24.6 percent of the $25.46 trillion economy. The only years it was higher was from 1943 to 1945, when it reached a high of 40.7 percent in 1944, and in 2020 and 2021 for Covid, when it reached 31.1 percent and 29.2 percent, respectively.

And while spending is down from its 2021 peak of $6.8 trillion to its current $6.27 trillion level, we are still spending much more as a percentage of the economy than we were prior to Covid. In 2019, spending was just $3.4 trillion, that was only 20.8 percent of the then $21.3 trillion economy.

As for revenue, 2022 was a record year, collecting nearly $4.9 trillion, an all-time high. And at 19.2 percent of the economy, that is the fourth all-time greatest tax collection in modern American history. The only years greater were 1944, 1945 and 2000, when revenues reached 19.5 percent, 19.8 percent and 19.76 percent, respectively.

Yet, despite record tax collections—which OMB projects will slow down dramatically in 2023 along with the economy, which slowed down to 1.1 percent annualized growth in the first quarter of 2023 — the budget deficit was still $1.37 trillion. In the meantime, spending will keep increasing, to $6.37 trillion 2023 and $6.88 trillion in 2024, as the budget deficit again increases to $1.55 trillion and $1.73 trillion, respectively, over the next two years alone.

Since, Covid, the spending has proven to be inflationary, causing more than $6 trillion to be printed. During Covid in 2020 and 2021, the Federal Reserve set interest rates to near-zero, Congress spent and borrowed more than $5 trillion and the M2 money supply dramatically: it went from $15.3 trillion at the end of 2019 to the peak of $22.05 trillion, a 44 percent increase.

At the same time, the global economy was locking down, slowing down production and the government was paying people to stay home, literally too much money chasing too few goods, a perfect recipe for inflation, which peaked at 9.1 percent in June 2022 and is now down to 4.9 percent over the past 12 months, according to the latest data published by the Bureau of Labor Statistics.

The rapid expansion is now being offset by Federal Reserve monetary tightening, which has brought the Federal Funds Rate up to 5 percent to 5.25 percent, the rate at which banks lend to one another. The higher rates charged on banks lead to money destruction, and so the M2 money supply has actually begun to decrease from $22.05 trillion in April 2022 to its current level of $20.9 trillion, about a 5.2 percent decline, although the decrease is modest in comparison to the initial expansion.

Thanks to the record government spending, publicly traded debt will increase by $1.66 trillion in 2023 and $1.87 trillion in 2024 to $27.8 trillion, and when the Social Security, Medicare and other trust funds are added to the mix, the total debt will rise $34.8 trillion in 2024.

Unfortunately, the too much money aspect of the equation will continue mounting over the next decade as the total debt rises to $50.7 trillion by 2033, according to the White House Office of Management and Budget. Who’s going to lend us another $19.3 trillion in addition to refinancing the $31.4 trillion of debt we already have?

Why, U.S. financial institutions, retirement funds, hedge funds, mutual funds and so forth, of course, will be forced to continue accumulating U.S. treasuries, whose share of the publicly traded debt has risen from about 17 percent in 2008, or $1.7 trillion, to a massive $11.9 trillion, or 38 percent today — the largest single holder of the debt.

And as the Social Security and Medicare trust funds, which hold $6.7 trillion, become exhausted over the next decade or so, more and more of that debt will be falling upon the public to accumulate. Foreign central banks and financial institutions, which hold $7.4 trillion, cannot keep up with it. And when the Fed tries to keep up with it, as during Covid, the result is inflation. The central bank now holds $5.2 trillion.

That leaves U.S. banks and investors via their fiduciaries (which are banks) to continue accumulating what is turning out to be something of a major risk to their solvency when interest rates don’t behave.

Barring massive economic growth, the amount of money printing we will have to engage in to keep the banks liquid enough to continue buying treasuries could once again place inflationary pressure on the economy, leading to not only higher consumer costs but also higher government costs than presently anticipated.

McCarthy says he has a stopgap solution while Congress considers the longer-term budget picture, spending caps under the House-passed debt ceiling increase, the Limit, Save, Grow Act, stating, “I think it's fair to say I'm in agreement with Limit, Save, Grow. That we can raise the debt ceiling if we limit what we're going to spend in the future, you put caps so we have adult supervision. I mean, how much is too much?”

H.R. 2811, the Limit, Save, Grow Act of 2023, according to the Congressional Budget Office, would increase the national debt ceiling and cut $4.8 trillion in deficits through 2033: $3.2 trillion from the discretionary spending caps, $460 billion from ending President Biden’s student loan forgiveness program, $569.5 billion from repealing the green energy subsidies from the Inflation Reduction Act and other legislation, $120.1 billion from implementing work requirements for food stamps and other welfare programs, $29.5 billion from budget rescissions from Covid and other spending, $3.4 billion from energy leasing and permitting provisions and $547 billion as a result of less interest payments owed thanks to cutting spending.

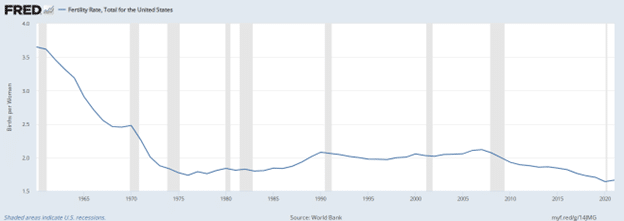

But even still, the debt would still be about $45 trillion by 2033, as Social Security, Medicare and interest payments owed on the debt continue mounting, while the share of workers to retirees will continue to shrink thanks to less-than-replacement fertility levels since the 2008 and 2009 recession. Fewer people means fewer workers and ultimately taxpayers, creating stress on the social insurance programs.

You can thank birth control, not an item under consideration in the budget talks (maybe it should be) but highly relevant all the same: as more women go to college and enter to the workforce, combined with unfavorable economic circumstances including the rising cost of living and raising children, they defer both marriage and child rearing. Since the 1960s when birth control first became widely adopted in the U.S., the amount of babies per woman decreased below the replacement level of two in the 1970s, stabilized above two from 1989 to 2009, and then crashed after the financial crisis. Fiscally this has created a death spiral from which there appears no escape.

Fertility in the U.S. hit an all-time low of 1.64 babies per woman in 2020 and 1.66 babies per woman in 2021, according to the World Bank. To paraphrase McCarthy, how little is too little?

Immigration is often seen as a stopgap, but with fertility declining globally, too, it likely is not a long-term solution to the demographic decline we are experiencing.

So, yes, Speaker McCarthy, we do have a spending problem, but we also have a not enough Americans problem. The truth is, if we kept having children at the same rate as we had prior to the 1960s, the budget might very well be balanced today, and the debt would be much smaller. But with the debt ceiling looming, that is a discussion that will almost certainly be left for another day.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

Video: House Oversight Committee CLOSING IN On Biden Family Corruption

To view online: https://www.youtube.com/watch?v=eFWQGhjp4T8

Video: Sen. Cruz Just Unleashed the TRUTH about Russian Collusion … You Won’t Believe What He Said!

To view online: https://www.youtube.com/watch?v=F_Au_SKnWPo

Video: Republicans Unite On Debt Ceiling – What’s Stopping Biden?

To view online: https://www.youtube.com/watch?v=nfGNnXgKBks

Thomas Catenacci and Joe Schoffstall: Biden admin coordinated with liberal dark money behemoth on 'transforming food system,' emails show

By Thomas Catenacci and Joe Schoffstall

The Biden administration coordinated with Eric Kessler, the founder and principal of the Arabella Advisors consulting firm, which oversees a behemoth liberal dark money network, on key agriculture policy issues, according to emails obtained by Fox News Digital.

The internal Department of Agriculture (USDA) communications — obtained by Americans for Public Trust (APT) and shared with Fox News Digital — show that Kessler was involved in initiatives to "transform" the U.S. food system and to crack down on the meat industry for high prices. Kessler was the only individual on the email chains who wasn't affiliated with the USDA.

"These emails reveal that Eric Kessler has direct access to Biden cabinet officials and plays an intimate role in shaping this administration’s agenda," APT executive director Caitlin Sutherland told Fox News Digital.

"As the architect and operator of the largest dark money network in U.S. politics, Kessler’s cozy relationship with Secretary Vilsack raises questions about the level of influence his foreign-funded Arabella network has on the Biden administration and its policies," she continued.

On July 15, 2021, Agriculture Secretary Tom Vilsack emailed Kessler, Marty Matlock, a USDA senior advisor for food systems resiliency, and Matthew McKenna, a former senior advisor to Vilsack, expressing his excitement about a food processing initiative that he noted the three were helping to "direct and lead."

"Gentlemen- woke up very early this morning thinking about the processing project you are helping to direct and lead," Vilsack wrote in the email. "I can tell you from the response I have received to date there is excitement over the possibility of this helping to create a more dynamic and competitive market."

Copied on the email were Vilsack's chief of staff Katharine Ferguson and Mae Wu, the USDA's deputy under secretary of marketing and regulatory programs.

The remainder of the July 2021 email was redacted because it contained information that was "pre-decisional" and deliberative, meaning it was related to a policy not yet in effect.

"I believe the pipeline will fill quickly," Kessler responded 20 minutes later. "This is striking a real chord and filling a huge need. The feedback I've heard has been 100% positive around the initiative and the Department's leadership."

Then, shortly after Kessler's response, Matlock indicated that he and McKenna had included the Arabella Advisors founder in conversations about the project.

"Matt, Eric and I have been in nearly daily conversation about elements and strategies," Matlock wrote. "In short we are on the job, moving the many elements necessary, and building program strategies for implementation."

Months later, in September 2021, Vilsack emailed Kessler and McKenna in an email that USDA completely redacted. However, Kessler responded, thanking Vilsack for the "kind invitation" and adding that he was "looking forward to it."

On Oct. 31, 2021, Vilsack sent another email to Kessler and USDA officials, asking for feedback on a "processing memo." Much of the email was redacted.

And, on Dec. 6, 2021, the agriculture secretary suggested edits to a "transformed food system" memo in an email to Wu and Jenny Moffitt, the USDA's under secretary of marketing and regulatory programs, with Kessler copied.

"I have reviewed the memo that you prepared on our transforming food system effort," Vilsack wrote. "Appreciate the thought and work that was put into it."

Wu responded, saying that she was scheduled to brief the White House on the transforming food system initiative.

The communications and coordination on the effort appears to have led to a Jan. 3, 2022, event at the White House where President Biden, Vilsack and Attorney General Merrick Garland announced steps that administration would take to "increase processing options" for farmers and ranchers. The event highlighted in part how the Justice Department would work with the USDA on federal enforcement efforts.

"The President was extremely appreciative of your effort," Vilsack wrote to USDA officials and Kessler after the event. "The White House/NEC is anxious to work with us on both the next steps to implement the processing effort and on the supply chain effort."

"It was a good day for USDA and allowed us to get nearly 2 hours of the President’s day focused on your work," the agriculture secretary added. "Just wanted you all to know the President and I very much appreciate the sacrifices of time you have made to get us to this point."

Kessler emailed Vilsack in response a day later, saying the White House event "was tremendous." He also said the effort was just beginning.

"A huge success and, while it’s just the beginning of this, it is already a major accomplishment," Kessler told Vilsack. "I have been getting lots of appreciative emails for the effort the Department put into this and offers far and wide to help in any way. Thank you for your steady pursuit of a level playing field and a better food system."

The USDA, though, said the emails and close coordination between Kessler, Vilsack and other top agency officials was an example of its broad stakeholder engagement efforts.

"There is significant private and philanthropic sector interest in leveraging the Department of Agriculture’s investments in food, agriculture and rural prosperity, such as the $1 billion USDA is investing to expand meat and poultry processing capacity to provide more options for farmers," a USDA spokesperson told Fox News Digital in a statement.

"External partners are critical in USDA’s effort to maximize our investment in a way that creates new markets and increases income opportunities for producers," the statement added.

Kessler's Arabella Advisors, which is based in Washington, D.C., is a consulting firm that manages at least five nonprofit organizations — Sixteen Thirty Fund, New Venture Fund, Hopewell Fund, Windward Fund and North Fund — that, in turn, host and funnel money to dozens of shadowy left-wing groups. In 2021, the latest year with available data, the network hauled in more than $1.5 billion in anonymous donations.

The funds are involved in a series of social and progressive campaigns around the world. They have also focused particularly on climate change initiatives.

And funds in the network have also given millions of dollars to agriculture-related programs.

"Arabella’s Good Food team works alongside funders, investors, and others who are passionate about transforming our food systems," the firm's website states. "Together, we’re creating a world where delicious, nutritious, sustainably produced food is accessible to all."

Kessler and Arabella Advisors didn't respond to a request for comment.

To view online: https://www.foxnews.com/politics/biden-admin-coordinated-liberal-dark-money-behemoth-transforming-food-system-emails-show