May 10, 2023

Permission to republish original opeds and cartoons granted.

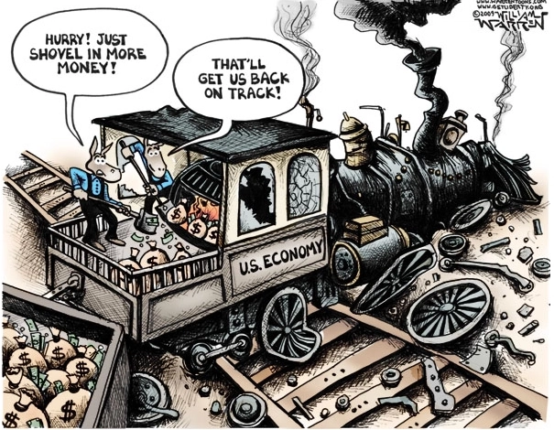

With inflation still elevated, thanks to rampant government spending, so will interest rates as the debt spirals to $50 trillion by 2033

By Robert Romano

Consumer inflation remained elevated in April, coming in at 4.9 percent over the past 12 months, according to the latest data published by the Bureau of Labor Statistics, in part due to a cut in oil production by OPEC+ globally that pushed gasoline prices higher, which increased 2.7 percent last month.

The news comes after the Federal Reserve moved to increase the Federal Funds Rate to 5 percent to 5.25 percent on May 3, showing that the worst of the inflation may not be past us just yet, even as we are past the June 2022 peak of 9.1 percent annualized after printing, spending and borrowing more than $6 trillion for Covid, which came at a time economic lockdowns and production halts.

It was too much money chasing too few goods, sending prices spiraling—along with interest rates in a bid to calm the inflation.

Thanks to massive government spending — publicly traded debt will increase by $1.66 trillion in 2023 and $1.87 trillion in 2024 to $27.8 trillion, and when the Social Security, Medicare and other trust funds are added to the mix, the total debt will rise $34.8 trillion in 2024 — the too much money aspect of the equation will continue mounting over the next decade as the total debt rises to $50.7 trillion by 2033, according to the White House Office of Management and Budget.

Unfortunately, one of the now apparent side effects of such massive deficits is the increasing burden it places on U.S. financial institutions, retirement funds, hedge funds, mutual funds and so forth to continue accumulating U.S. treasuries, whose share of the publicly traded debt has risen from about 17 percent in 2008, or $1.7 trillion, to a massive $11.9 trillion, or 38 percent today — the largest single holder of the debt.

And as the Social Security and Medicare trust funds, which hold $6.7 trillion, become exhausted over the next decade or so, more and more of that debt will be falling upon the public to accumulate. Foreign central banks and financial institutions, which hold $7.4 trillion, cannot keep up with it. And when the Fed tries to keep up with it, as during Covid, the result is inflation. The central bank now holds $5.2 trillion.

That leaves U.S. banks and investors via their fiduciaries (which are banks) to continue accumulating what is turning out to be something of a major risk to their solvency when interest rates don’t behave.

The next decade alone, net interest owed on the debt is set to rise from $665 billion a year to a nearly $1.4 trillion a year by 2033. It’s enough to make your eyes bleed.

During recessions, the Fed tends to cut interest rates in a bid to boost liquidity and ease lending conditions, to foster conditions for lowering the unemployment rate. But when there’s inflation, the Fed has to hike interest rates to fight it, thereby reducing the value of the bonds the Treasury was selling at much lower interest rates. In this cycle alone, it has resulted in the failures of First Republic Bank, Silicon Valley Bank and Signature Bank, the second, third and fourth largest bank failures in American history.

The Federal Reserve’s new Bank Term Funding Program — “renting” treasuries from banks at 100 pennies on the dollar — has risen from $11 billion in March to more than $75 billion today, and the worst could be yet to come, as banks are said to be sitting on some $600 billion of unrealized losses due to rising interest rates resulting in underwater securities.

As for the productions shortfalls, those might not get much better, with U.S. oil companies going green in a bid to reduce carbon emissions, with crude oil production still below that of pre-Covid levels of 13 million barrels a day. In Feb. 2023 it stood in at 12.48 million barrels a day, according to the U.S. Energy Information Administration, despite the high prices we were experiencing in 2022 particularly after Russia invaded Ukraine, further exacerbating supply chain issues in the global economy.

So, if we keep spending too much money—and printing it—and not producing enough goods, that means inflation could be quite sticky over the foreseeable future. That is, until the economy truly overheats, causing a recession and a drop in demand, sending prices crashing as unemployment rises. Then the Fed will cut interest rates, the budget deficit will balloon thanks to less revenue and the debt cycle will continue anew as banks continue accumulating vast hordes of useless treasuries, further diverting resources from boosting production. What’s not to love?

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

Video: Tucker Carlson’s Sabotage Nightmare: Meet Irena Briganti

To view online: https://www.youtube.com/watch?v=oXT-1pq9NI8

Breaking: Speaker McCarthy Visits the White House: What You NEED To Know!

To view online: https://www.youtube.com/watch?v=K9Xje45XmwA

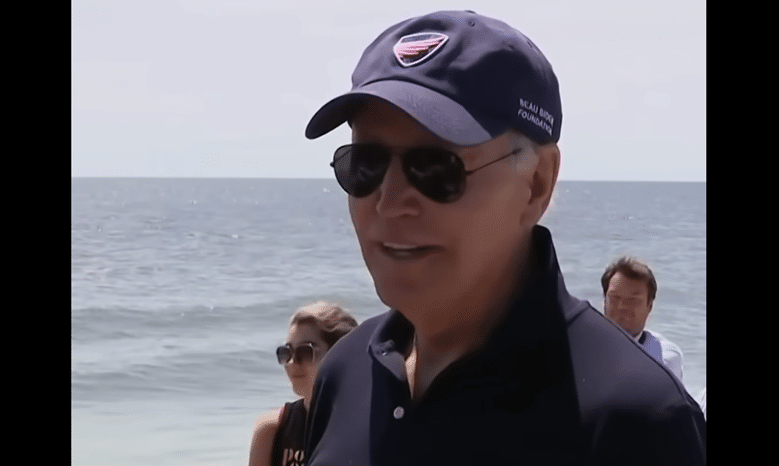

Troubling Numbers for Biden – 60% of Young people and Independents Disapprove of His Job as President

By Manzanita Miller

A new Washington Post/ABC News poll shows Americans are as reluctant as ever for another four years under President Biden just under two weeks after he officially announced his reelection campaign.

Biden struggles with support from within his own party, with a full 58% of Democrats stating they’d like the Democratic Party to nominate someone other than Biden for the 2024 presidential election.

A mounting share of Democrats are moving toward Democratic primary challengers Robert F. Kennedy Jr. and Marianne Williamson, with each candidate doubling their support over the past month.

However, it is Biden’s numbers with swing voters that present a particularly bleak picture for his reelection prospects.

Biden currently has a 60% disapproval rating among Independents, a group he won easily in 2020, and a 60% disapproval rating among voters 18-39, another group he won easily then. Biden is also struggling with Democrat leaners, liberals and moderates, with a disapproval rating of 21% among Democrat leaners, 16% among liberals and 49% among moderates.

Biden is also struggling significantly with non-college voters who have been significantly impacted by the federal government’s response to the covid-19 pandemic, and currently sits at a disapproval rating of 63% among non-college voters that rises to 68% among non-college whites. When gender is added to the mix, a full 70% among non-college white men and 66% of non-college white women disapprove of Biden.

President Biden has also been unable to budge his approval rating among non-white voters, with the latest ABC News poll showing he sits at a disapproval rating of 52% with Hispanics and 48% among all non-white voters.

According to the survey, Biden’s age plays a significant role in Americans' reluctance to support his reelection. A staggering 68% of Americans believe that the president is too old to serve another term. Biden, currently 80 years old, would conclude his term at 86 years old if reelected.

A majority of voters do not harbor the same concerns about Trump, who is 76 years old. Only 44% of voters consider Trump to be too old for the presidency. Beyond just chronological age, Trump surpasses Biden in terms of perceived mental sharpness and physical health. Doubts about Biden's abilities in both these areas are widely held among the electorate.

These are all signs that both the far left and the moderate center of the Democratic Party are beginning to question Biden’s competence and are driving momentum toward Kennedy and Williamson.

While Biden's popularity has declined among Democrats and supporters across the board, his falling numbers with Independents, young people, women, and non-college whites, are particularly threatening to his reelection prospects. It comes as no surprise that Robert F. Kennedy Jr. and self-help author Marianne Williamson are gaining support from these demographics.

A recent poll conducted by Emerson College shows Kennedy polling at 21%, while Williamson has reached 9%. Kennedy's performance in this poll is notable, with 17.1% of Democrats and an impressive 33.7% of Independents expressing their support for him.

Just a month ago, Kennedy's poll numbers stood at 10% and Williamson's at 4%, as indicated by a Morning Consult poll, suggesting that both challengers have recently doubled their support.

Kennedy performs particularly well among women, voters over the age of 65, and non-college educated Democrats, while Williamson does best with women, younger voters, and college-educated Democrats.

A recent Morning Consult poll reveals that 13% of women, compared to 7% of men, would back Kennedy as a primary challenger. Among voters over the age of 65, 17% express support for Kennedy, while younger age groups hover around 9%. Similarly, 12% of non-college Democrats support Kennedy, compared to 10% of college graduates. These findings suggest that Kennedy has an advantage among working-class and voters.

Biden's support has also declined substantially among Democratic women compared to men. The share of men who say they would support Biden in the primaries stands at 78%, while only 61% of women express the same sentiment, a nearly twenty-percentage point difference.

When Democratic leaners specifically were asked whether the party should nominate Biden again or someone else, a full 58% said the party should nominate someone else. These numbers were even higher for younger people and Independents who lean Democrat. A full three-quarters (76%) of young Democrat leaners said the party should nominate someone else, as did 64% of non-whites who lean Democrat.

The ABC News poll also shows Trump ahead of Biden by six percentage points in a head-to-head match up, with Trump garnering 44% of the vote to Biden’s 38%. When pitting Biden against Florida Governor Ron DeSantis, DeSantis led Biden by five percentage points, 42% to 37%.

When it comes to public opinion, the outlook for Biden is bleak. His approval rating sits at just 36%, with a full 56% disapproval rating, including a substantial 47% strongly disapproving. A wide majority of Americans said they think Biden lacks the physical health and mental acuity to serve as president.

Trump did much better in the poll, with 64% of voters saying Trump is physically fit enough to serve as president, and 54% saying he is mentally stable enough to do so.

The same poll showed Americans say 54% to 36% that former President Trump would do a better job of handling the economy than President Biden, with wide agreement among Independent and Democratic leaning groups. Over half (54%) of Independents said Trump would do a better job of handling the economy than Biden, and 18% of democratic Leaners agreed. Young people said by an almost two-to-one margin that former President Trump would be a better steward of the economy (57% to 28%), and Hispanics agreed Trump would be better at handling the economy 54% to 36%.

Americans are in broad agreement that President Biden is not only unfit to handle his job as president, but his health and age are serious concerns for the next six years. Democrats, Democratic-leaners, and swing voters including young people and Independents are increasingly in agreement that the party should nominate someone other than Biden for 2024. What is more, Trump’s approval rating and the share of Americans who believe he should run for president has accelerated rapidly since Biden officially announced his reelection. President Biden did not enjoy a bump in the polls after his reelection announcement, and if anything is losing ground to his challenges R.F.K. and Marianne Williamson.

Manzanita Miller is an associate analyst at Americans for Limited Government Foundation.

To view online: https://dailytorch.com/2023/05/troubling-numbers-for-biden-60-of-young-people-and-independents-disapprove-of-his-job-as-president/

With inflation still elevated, now is the time to cut spending with Limit, Save, Grow

May 9, 2023, Fairfax, Va.—Americans for Limited Government President Rick Manning today issued the following statement urging the Senate to pass the Limit, Save, Grow Act:

“With inflation still elevated… [and] the Federal Reserve having recently increased interest rates again, it is safe to say that interest costs on the $31.4 trillion national debt will continue to mount. Since government spending in recent years has been one of the primary drivers for too much money flooding the system, coming at a time of economic lockdowns and production halts from Covid, it was chasing too few goods.

“Since Covid ended in 2021, interest rates on 10-year treasuries have increased from about 1.5 percent to 3.5 percent at a time when the U.S. has been accumulating trillions of dollars of new debt, which has increased by $8.5 trillion since Jan. 2020, $7.8 trillion of which is publicly tradeable debt. In the meantime, in the next year alone, $7.1 trillion, or about 29.1 percent of the $24.6 trillion publicly tradeable debt will be coming due, according to the latest data from the U.S. Treasury.

“That is why the House Republican-offered Limit, Save, Grow Act is a reasonable approach to begin getting our spending under control. Over the next 10 years, interest owed on the debt alone will total more than $10 trillion, according to the White House Office of Management and Budget. The House plan would shave just $547 billion off of that, according to the Congressional Budget Office, in addition to another $4.3 trillion of real spending cuts. Consider that, $4.3 trillion of cuts only gets you $547 billion less debt service. This is why Limit, Save, Grow is just the first step in getting our fiscal house in order. It also why the Grow portion of Limit, Save, Grow is essential, because aggressive economic growth is the only way out the massive debt abyss that threatens to engulf us.”

To view online: https://getliberty.org/2023/05/with-inflation-still-elevated-now-is-the-time-to-cut-spending-with-limit-save-grow/