|

John,

These numbers are very telling:

House Republicans passed a bill that would cut nearly $5 trillion in services for children, working people, and the poor.[1] They claim to be tightening the country’s belt to pay down our national debt. But what’s their real motivation?

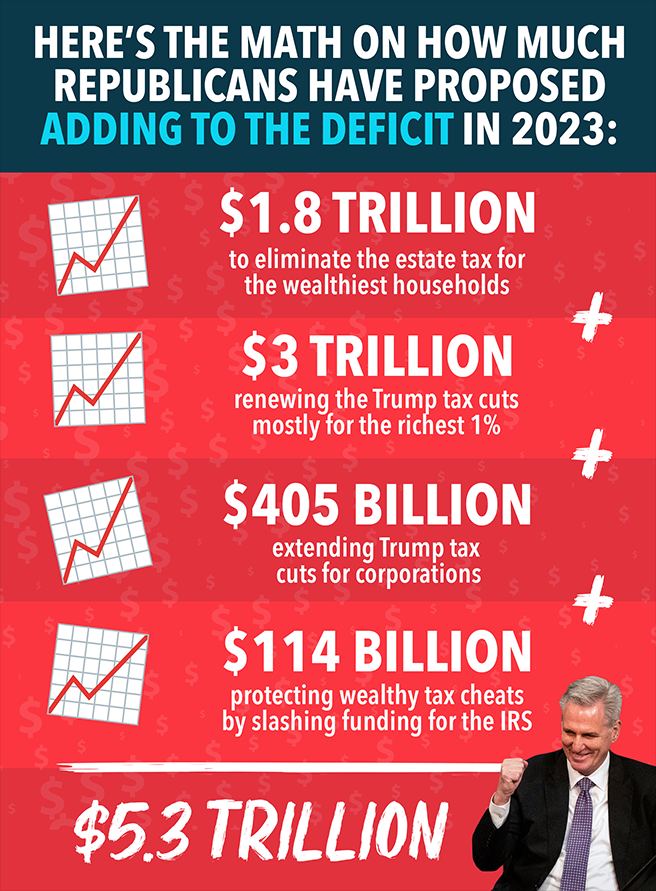

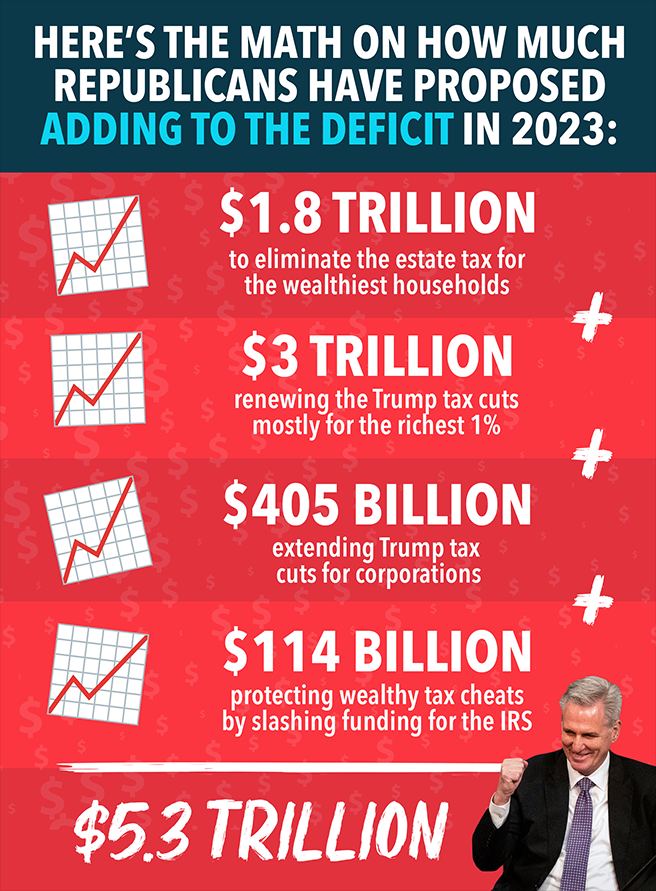

It turns out that congressional Republicans have introduced multiple bills that would ADD a combined $5.3 trillion to the national debt.[2] So, they’re really taking food, housing, and healthcare away from working people who are trying to make ends meet just to pay for even more tax breaks for the rich.

Check out our latest infographic below, then donate $5 to bring it to voters across the country.

On Tuesday, congressional leaders will meet at the White House to discuss the impasse over raising the debt ceiling―which really comes down to whether we will allow the U.S. Treasury to continue to pay the bills that Congress has already authorized.

Together, we’re letting President Biden and Senate Democrats know that when they stand up to right-wing hostage takers we’ll have their backs. Because we know that when the wealthy and corporations pay their fair share of taxes, we can protect, improve and expand—not cut—critical services for working people.

Thank you,

Andrea Haverdink

Digital Director

Americans for Tax Fairness Action Fund

[1] “House Debt Ceiling Bill Cuts Deficits by $4.8 Trillion Over 10 Years, CBO Says,” The Wall Street Journal, Apr. 25, 2023

[2] Republican Tax Bills 118th Congress

-- David's email --

John,

Republicans are demanding massive cuts to everything from healthcare to nutrition to education under the guise of deficit reduction. But, before passing Kevin McCarthy’s “Default on America Act,” they spent the first four months of the year introducing legislation that would add $5.3 TRILLION to our national debt.[1]

While Republicans are holding our economy hostage, claiming they will only raise the country’s debt limit in exchange for dangerous cuts to services for working people, Democrats and President Biden are calling for an expansion of benefits, paid for by asking the wealthy and corporations to pay their fair share. And President Biden’s plan would still reduce the deficit by trillions of dollars.

Help bring our latest infographic below to voters across the country and let them know that congressional Republicans don’t really care about our national debt. If they did, they wouldn’t have introduced multiple bills that blow up our debt while handing even more tax breaks to the rich and corporations. Donate today!

The largest GOP giveaway is to make the Trump tax cuts for the wealthy permanent -- costing the country $3 trillion.

The next largest is eliminating the estate tax, which only applies to approximately 1,900 very wealthy families each year. A couple has to be worth over $25 million to pay a nickel in estate tax. Eliminating the estate tax would cost U.S. taxpayers an additional $1.8 trillion.

And, of course, they want to take away new IRS funding so that rich and corporate tax cheats can continue evading the taxes they already owe.

Donate today to bring our latest infographic to voters across the country and show the American people how House Republicans only care about the country’s debt when they want to take healthcare and food away from poor children and families.

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

Thank you for fighting for a future that includes all of us, not just the wealthy few.

David Kass

Executive Director

Americans for Tax Fairness Action Fund

[1] Republican Tax Bills 118th Congress

|