| From | Fraser Institute <[email protected]> |

| Subject | Provincial government's fiscal response, and 2022 survey of mining companies |

| Date | May 6, 2023 5:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Having trouble viewing? Try the web version [link removed] of this email. Latest Research Higher deficit-financed spending by provincial governments leads to 26% higher taxes and 10% higher debt interest costs, historical analysis shows [[link removed]]

How Provincial Governments Respond to Fiscal Shocks and Federal Transfers is a new study that finds despite misperceptions that government deficits have no cost, higher deficit-financed spending by provincial governments over the past 50 years has, in fact, led to higher taxes and higher debt-servicing costs for taxpayers.

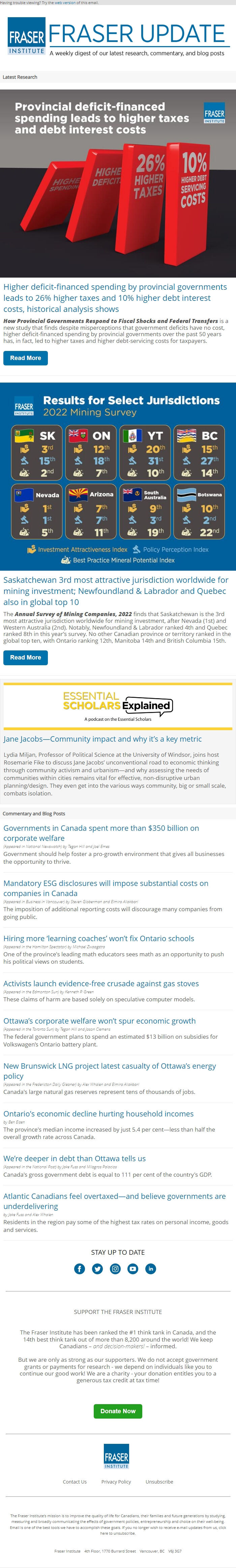

Read More [[link removed]] Saskatchewan 3rd most attractive jurisdiction worldwide for mining investment; Newfoundland & Labrador and Quebec also in global top 10 [[link removed]]

The Annual Survey of Mining Companies, 2022 finds that Saskatchewan is the 3rd most attractive jurisdiction worldwide for mining investment, after Nevada (1st) and Western Australia (2nd). Notably, Newfoundland & Labrador ranked 4th and Quebec ranked 8th in this year’s survey. No other Canadian province or territory ranked in the global top ten, with Ontario ranking 12th, Manitoba 14th and British Columbia 15th.

Read More [[link removed]] Jane Jacobs—Community impact and why it’s a key metric [[link removed]]

Lydia Miljan, Professor of Political Science at the University of Windsor, joins host Rosemarie Fike to discuss Jane Jacobs’ unconventional road to economic thinking through community activism and urbanism—and why assessing the needs of communities within cities remains vital for effective, non-disruptive urban planning/design. They even get into the various ways community, big or small scale, combats isolation.

Commentary and Blog Posts Governments in Canada spent more than $350 billion on corporate welfare [[link removed]] (Appeared in National Newswatch) by Tegan Hill and Joel Emes

Government should help foster a pro-growth environment that gives all businesses the opportunity to thrive.

Mandatory ESG disclosures will impose substantial costs on companies in Canada [[link removed]] (Appeared in Business in Vancouver) by Steven Globerman and Elmira Aliakbari

The imposition of additional reporting costs will discourage many companies from going public.

Hiring more ‘learning coaches’ won’t fix Ontario schools [[link removed]] (Appeared in the Hamilton Spectator) by Michael Zwaagstra

One of the province's leading math educators sees math as an opportunity to push his political views on students.

Activists launch evidence-free crusade against gas stoves [[link removed]] (Appeared in the Edmonton Sun) by Kenneth P. Green

These claims of harm are based solely on speculative computer models.

Ottawa’s corporate welfare won’t spur economic growth [[link removed]] (Appeared in the Toronto Sun) by Tegan Hill and Jason Clemens

The federal government plans to spend an estimated $13 billion on subsidies for Volkswagen’s Ontario battery plant.

New Brunswick LNG project latest casualty of Ottawa’s energy policy [[link removed]] (Appeared in the Fredericton Daily Gleaner) by Alex Whalen and Elmira Aliakbari

Canada's large natural gas reserves represent tens of thousands of jobs.

Ontario's economic decline hurting household incomes [[link removed]] by Ben Eisen

The province's median income increased by just 5.4 per cent—less than half the overall growth rate across Canada.

We’re deeper in debt than Ottawa tells us [[link removed]] (Appeared in the National Post) by Jake Fuss and Milagros Palacios

Canada's gross government debt is equal to 111 per cent of the country's GDP.

Atlantic Canadians feel overtaxed—and believe governments are underdelivering [[link removed]] by Jake Fuss and Alex Whalen

Residents in the region pay some of the highest tax rates on personal income, goods and services.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

How Provincial Governments Respond to Fiscal Shocks and Federal Transfers is a new study that finds despite misperceptions that government deficits have no cost, higher deficit-financed spending by provincial governments over the past 50 years has, in fact, led to higher taxes and higher debt-servicing costs for taxpayers.

Read More [[link removed]] Saskatchewan 3rd most attractive jurisdiction worldwide for mining investment; Newfoundland & Labrador and Quebec also in global top 10 [[link removed]]

The Annual Survey of Mining Companies, 2022 finds that Saskatchewan is the 3rd most attractive jurisdiction worldwide for mining investment, after Nevada (1st) and Western Australia (2nd). Notably, Newfoundland & Labrador ranked 4th and Quebec ranked 8th in this year’s survey. No other Canadian province or territory ranked in the global top ten, with Ontario ranking 12th, Manitoba 14th and British Columbia 15th.

Read More [[link removed]] Jane Jacobs—Community impact and why it’s a key metric [[link removed]]

Lydia Miljan, Professor of Political Science at the University of Windsor, joins host Rosemarie Fike to discuss Jane Jacobs’ unconventional road to economic thinking through community activism and urbanism—and why assessing the needs of communities within cities remains vital for effective, non-disruptive urban planning/design. They even get into the various ways community, big or small scale, combats isolation.

Commentary and Blog Posts Governments in Canada spent more than $350 billion on corporate welfare [[link removed]] (Appeared in National Newswatch) by Tegan Hill and Joel Emes

Government should help foster a pro-growth environment that gives all businesses the opportunity to thrive.

Mandatory ESG disclosures will impose substantial costs on companies in Canada [[link removed]] (Appeared in Business in Vancouver) by Steven Globerman and Elmira Aliakbari

The imposition of additional reporting costs will discourage many companies from going public.

Hiring more ‘learning coaches’ won’t fix Ontario schools [[link removed]] (Appeared in the Hamilton Spectator) by Michael Zwaagstra

One of the province's leading math educators sees math as an opportunity to push his political views on students.

Activists launch evidence-free crusade against gas stoves [[link removed]] (Appeared in the Edmonton Sun) by Kenneth P. Green

These claims of harm are based solely on speculative computer models.

Ottawa’s corporate welfare won’t spur economic growth [[link removed]] (Appeared in the Toronto Sun) by Tegan Hill and Jason Clemens

The federal government plans to spend an estimated $13 billion on subsidies for Volkswagen’s Ontario battery plant.

New Brunswick LNG project latest casualty of Ottawa’s energy policy [[link removed]] (Appeared in the Fredericton Daily Gleaner) by Alex Whalen and Elmira Aliakbari

Canada's large natural gas reserves represent tens of thousands of jobs.

Ontario's economic decline hurting household incomes [[link removed]] by Ben Eisen

The province's median income increased by just 5.4 per cent—less than half the overall growth rate across Canada.

We’re deeper in debt than Ottawa tells us [[link removed]] (Appeared in the National Post) by Jake Fuss and Milagros Palacios

Canada's gross government debt is equal to 111 per cent of the country's GDP.

Atlantic Canadians feel overtaxed—and believe governments are underdelivering [[link removed]] by Jake Fuss and Alex Whalen

Residents in the region pay some of the highest tax rates on personal income, goods and services.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor