| From | American Energy Alliance <[email protected]> |

| Subject | Thanks to coal |

| Date | April 27, 2023 4:47 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Your Daily Energy Life

View this email in your browser ([link removed])

DAILY ENERGY NEWS | 04/27/2023

Subscribe Now ([link removed])

** Unsurprisingly, people like modern life and the comforts that it affords.

------------------------------------------------------------

Japan Times ([link removed]) (4/25/23) reports: "A windy monsoon in Karnataka, India’s leading state for clean energy production, last year eased pressure on the local government’s three thermal coal-power plants, as humming wind turbines met power demand amid pleasant temperatures. But to tackle this year’s hot, energy-guzzling summer, with city-dwellers ramping up their use of air-conditioners and farmers their water pumps to combat heat waves and above-normal temperatures, the coal-fed plants are now running full throttle...India has set a target for 500 gigawatts (GW) of renewable energy capacity by 2030 — also the year by which the country’s coal demand is estimated to rise by 60%, to up to 1.5 billion metric tons, to meet growing electricity needs...Kapil Mohan, additional chief secretary with Karnataka’s energy department, described April as the 'peak summer month' with record

temperatures and high power consumption. Solar energy production is plentiful during summer, but wind power tends to decrease and hydropower reservoirs go dry, he added. 'Our dependence on fossil fuel in the energy sector is not going to drastically come down,' he said. 'My energy surplus is not constant and I need to supply power round-the-clock.'"

[link removed]

** "In the United States, we can have high human rights standards, high environmental standards, along with high production of mineral and energy resources. Producing energy and minerals in the United States helps build our energy security. "

------------------------------------------------------------

– The Honorable Daniel Simmons, Simmons Energy and Environment Strategies ([link removed])

============================================================

This Climate Stuff ain't pannin' out for regular people.

** CNBC ([link removed])

(4/26/23) reports: "Companies and workers are trying to pass the impact of inflation onto each other — and that risks persistent inflation, according to Huw Pill, the Bank of England's chief economist. 'What we're facing now is that reluctance to accept that yes we're all worse off, we all have to take our share,' Pill said on an episode of Columbia Law School and the Millstein Center's 'Beyond Unprecedented' podcast, released on Tuesday. 'To try and pass that cost on to one of our compatriots and say, we'll be alright but they will have to take our share — that pass the parcel game ... is one that is generating inflation,' he said. Pill was discussing the "series of inflationary shocks" that had fueled inflation over the last 18 months, from pandemic supply disruption and government household support programs boosting demand, to the Russian invasion of Ukraine and resulting spike in European energy prices. That has been followed by adverse weather and an outbreak of avian flu driving up

food prices. But Pill said that was not the whole story, and that it was "natural" that the behavior of price-setters and wage-setters in economies including the U.K. and U.S. would change when living costs such as energy bills rise, with workers asking for higher salaries and businesses raising prices. 'Of course, that process is ultimately self-defeating,' said Pill. He added that the U.K., which is a net importer of natural gas, faced a situation where the goods it buys from the rest of the world had gone up a lot relative to what it is selling to the rest of the world, primarily services. The U.K. imports nearly half its food."

"General" Granholm of the 46th all-electric armored division.

Despite the regime's efforts, the show will go on!

** EIA ([link removed])

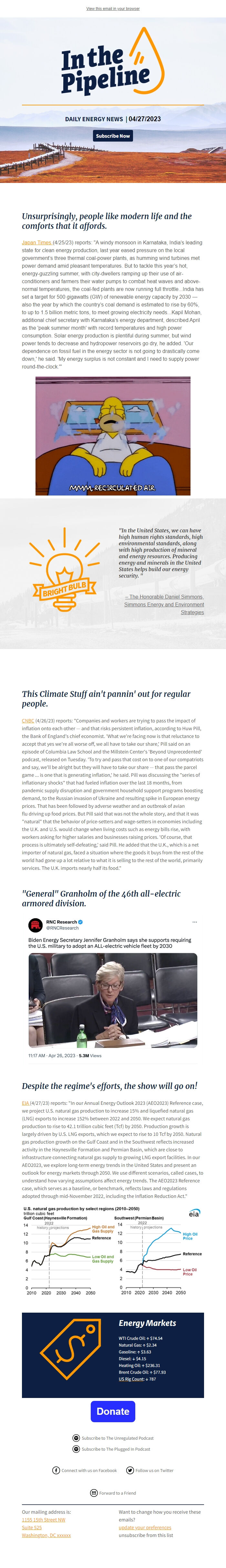

(4/27/23) reports: "In our Annual Energy Outlook 2023 (AEO2023) Reference case, we project U.S. natural gas production to increase 15% and liquefied natural gas (LNG) exports to increase 152% between 2022 and 2050. We expect natural gas production to rise to 42.1 trillion cubic feet (Tcf) by 2050. Production growth is largely driven by U.S. LNG exports, which we expect to rise to 10 Tcf by 2050. Natural gas production growth on the Gulf Coast and in the Southwest reflects increased activity in the Haynesville Formation and Permian Basin, which are close to infrastructure connecting natural gas supply to growing LNG export facilities. In our AEO2023, we explore long-term energy trends in the United States and present an outlook for energy markets through 2050. We use different scenarios, called cases, to understand how varying assumptions affect energy trends. The AEO2023 Reference case, which serves as a baseline, or benchmark, reflects laws and regulations adopted through mid-November

2022, including the Inflation Reduction Act."

Energy Markets

WTI Crude Oil: ↑ $74.54

Natural Gas: ↑ $2.34

Gasoline: ↑ $3.63

Diesel: ↓ $4.15

Heating Oil: ↑ $236.31

Brent Crude Oil: ↑ $77.93

** US Rig Count ([link removed])

: ↓ 787

** Donate ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Connect with us on Facebook ([link removed])

** Connect with us on Facebook ([link removed])

** Follow us on Twitter ([link removed])

** Follow us on Twitter ([link removed])

** Forward to a Friend ([link removed])

** Forward to a Friend ([link removed])

Our mailing address is:

** 1155 15th Street NW ([link removed])

** Suite 525 ([link removed])

** Washington, DC xxxxxx ([link removed])

Want to change how you receive these emails?

** update your preferences ([link removed])

** unsubscribe from this list ([link removed])

View this email in your browser ([link removed])

DAILY ENERGY NEWS | 04/27/2023

Subscribe Now ([link removed])

** Unsurprisingly, people like modern life and the comforts that it affords.

------------------------------------------------------------

Japan Times ([link removed]) (4/25/23) reports: "A windy monsoon in Karnataka, India’s leading state for clean energy production, last year eased pressure on the local government’s three thermal coal-power plants, as humming wind turbines met power demand amid pleasant temperatures. But to tackle this year’s hot, energy-guzzling summer, with city-dwellers ramping up their use of air-conditioners and farmers their water pumps to combat heat waves and above-normal temperatures, the coal-fed plants are now running full throttle...India has set a target for 500 gigawatts (GW) of renewable energy capacity by 2030 — also the year by which the country’s coal demand is estimated to rise by 60%, to up to 1.5 billion metric tons, to meet growing electricity needs...Kapil Mohan, additional chief secretary with Karnataka’s energy department, described April as the 'peak summer month' with record

temperatures and high power consumption. Solar energy production is plentiful during summer, but wind power tends to decrease and hydropower reservoirs go dry, he added. 'Our dependence on fossil fuel in the energy sector is not going to drastically come down,' he said. 'My energy surplus is not constant and I need to supply power round-the-clock.'"

[link removed]

** "In the United States, we can have high human rights standards, high environmental standards, along with high production of mineral and energy resources. Producing energy and minerals in the United States helps build our energy security. "

------------------------------------------------------------

– The Honorable Daniel Simmons, Simmons Energy and Environment Strategies ([link removed])

============================================================

This Climate Stuff ain't pannin' out for regular people.

** CNBC ([link removed])

(4/26/23) reports: "Companies and workers are trying to pass the impact of inflation onto each other — and that risks persistent inflation, according to Huw Pill, the Bank of England's chief economist. 'What we're facing now is that reluctance to accept that yes we're all worse off, we all have to take our share,' Pill said on an episode of Columbia Law School and the Millstein Center's 'Beyond Unprecedented' podcast, released on Tuesday. 'To try and pass that cost on to one of our compatriots and say, we'll be alright but they will have to take our share — that pass the parcel game ... is one that is generating inflation,' he said. Pill was discussing the "series of inflationary shocks" that had fueled inflation over the last 18 months, from pandemic supply disruption and government household support programs boosting demand, to the Russian invasion of Ukraine and resulting spike in European energy prices. That has been followed by adverse weather and an outbreak of avian flu driving up

food prices. But Pill said that was not the whole story, and that it was "natural" that the behavior of price-setters and wage-setters in economies including the U.K. and U.S. would change when living costs such as energy bills rise, with workers asking for higher salaries and businesses raising prices. 'Of course, that process is ultimately self-defeating,' said Pill. He added that the U.K., which is a net importer of natural gas, faced a situation where the goods it buys from the rest of the world had gone up a lot relative to what it is selling to the rest of the world, primarily services. The U.K. imports nearly half its food."

"General" Granholm of the 46th all-electric armored division.

Despite the regime's efforts, the show will go on!

** EIA ([link removed])

(4/27/23) reports: "In our Annual Energy Outlook 2023 (AEO2023) Reference case, we project U.S. natural gas production to increase 15% and liquefied natural gas (LNG) exports to increase 152% between 2022 and 2050. We expect natural gas production to rise to 42.1 trillion cubic feet (Tcf) by 2050. Production growth is largely driven by U.S. LNG exports, which we expect to rise to 10 Tcf by 2050. Natural gas production growth on the Gulf Coast and in the Southwest reflects increased activity in the Haynesville Formation and Permian Basin, which are close to infrastructure connecting natural gas supply to growing LNG export facilities. In our AEO2023, we explore long-term energy trends in the United States and present an outlook for energy markets through 2050. We use different scenarios, called cases, to understand how varying assumptions affect energy trends. The AEO2023 Reference case, which serves as a baseline, or benchmark, reflects laws and regulations adopted through mid-November

2022, including the Inflation Reduction Act."

Energy Markets

WTI Crude Oil: ↑ $74.54

Natural Gas: ↑ $2.34

Gasoline: ↑ $3.63

Diesel: ↓ $4.15

Heating Oil: ↑ $236.31

Brent Crude Oil: ↑ $77.93

** US Rig Count ([link removed])

: ↓ 787

** Donate ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Connect with us on Facebook ([link removed])

** Connect with us on Facebook ([link removed])

** Follow us on Twitter ([link removed])

** Follow us on Twitter ([link removed])

** Forward to a Friend ([link removed])

** Forward to a Friend ([link removed])

Our mailing address is:

** 1155 15th Street NW ([link removed])

** Suite 525 ([link removed])

** Washington, DC xxxxxx ([link removed])

Want to change how you receive these emails?

** update your preferences ([link removed])

** unsubscribe from this list ([link removed])

Message Analysis

- Sender: American Energy Alliance (AEA)

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp