| From | Adriana Lasso-Harrier <[email protected]> |

| Subject | We're not gonna stop talking about this. |

| Date | February 3, 2020 11:39 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

[link removed] [[link removed]]

Hi John,

You’ve heard it before from us.

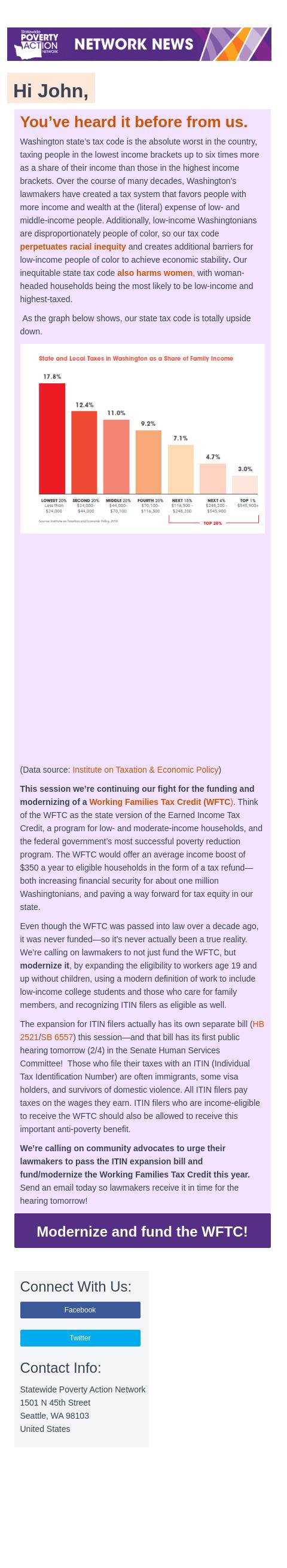

Washington state’s tax code is the absolute worst in the country, taxing people in the lowest income brackets up to six times more as a share of their income than those in the highest income brackets. Over the course of many decades, Washington’s lawmakers have created a tax system that favors people with more income and wealth at the (literal) expense of low- and middle-income people. Additionally, low-income Washingtonians are disproportionately people of color, so our tax code perpetuates racial inequity [[link removed]] and creates additional barriers for low-income people of color to achieve economic stability . Our inequitable state tax code also harms women [[link removed]] , with woman-headed households being the most likely to be low-income and highest-taxed.

As the graph below shows, our state tax code is totally upside down.

[[link removed]]

This session we’re continuing our fight for the funding and modernizing of a Working Families Tax Credit (WFTC [[link removed]] ) [[link removed]] . Think of the WFTC as the state version of the Earned Income Tax Credit, a program for low- and moderate-income households, and the federal government’s most successful poverty reduction program. The WFTC would offer an average income boost of $350 a year to eligible households in the form of a tax refund—both increasing financial security for about one million Washingtonians, and paving a way forward for tax equity in our state.

Even though the WFTC was passed into law over a decade ago, it was never funded—so it’s never actually been a true reality. We’re calling on lawmakers to not just fund the WFTC, but modernize it , by expanding the eligibility to workers age 19 and up without children, using a modern definition of work to include low-income college students and those who care for family members, and recognizing ITIN filers as eligible as well.

The expansion for ITIN filers actually has its own separate bill ( HB 2521 [[link removed]] / SB 6557 [[link removed]] ) this session—and that bill has its first public hearing tomorrow (2/4) in the Senate Human Services Committee! Those who file their taxes with an ITIN (Individual Tax Identification Number) are often immigrants, some visa holders, and survivors of domestic violence. All ITIN filers pay taxes on the wages they earn. ITIN filers who are income-eligible to receive the WFTC should also be allowed to receive this important anti-poverty benefit.

We’re calling on community advocates to urge their lawmakers to pass the ITIN expansion bill and fund/modernize the Working Families Tax Credit this year. Send an email today so lawmakers receive it in time for the hearing tomorrow!

Modernize and fund the WFTC! [[link removed]]

Connect With Us:Facebook [#] Contact Info:Statewide Poverty Action Network

1501 N 45th Street

Seattle, WA 98103

United States

Twitter [#]

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

We have recently moved to a new data system, please let us know if you are experiencing any issues with our new system.

Hi John,

You’ve heard it before from us.

Washington state’s tax code is the absolute worst in the country, taxing people in the lowest income brackets up to six times more as a share of their income than those in the highest income brackets. Over the course of many decades, Washington’s lawmakers have created a tax system that favors people with more income and wealth at the (literal) expense of low- and middle-income people. Additionally, low-income Washingtonians are disproportionately people of color, so our tax code perpetuates racial inequity [[link removed]] and creates additional barriers for low-income people of color to achieve economic stability . Our inequitable state tax code also harms women [[link removed]] , with woman-headed households being the most likely to be low-income and highest-taxed.

As the graph below shows, our state tax code is totally upside down.

[[link removed]]

This session we’re continuing our fight for the funding and modernizing of a Working Families Tax Credit (WFTC [[link removed]] ) [[link removed]] . Think of the WFTC as the state version of the Earned Income Tax Credit, a program for low- and moderate-income households, and the federal government’s most successful poverty reduction program. The WFTC would offer an average income boost of $350 a year to eligible households in the form of a tax refund—both increasing financial security for about one million Washingtonians, and paving a way forward for tax equity in our state.

Even though the WFTC was passed into law over a decade ago, it was never funded—so it’s never actually been a true reality. We’re calling on lawmakers to not just fund the WFTC, but modernize it , by expanding the eligibility to workers age 19 and up without children, using a modern definition of work to include low-income college students and those who care for family members, and recognizing ITIN filers as eligible as well.

The expansion for ITIN filers actually has its own separate bill ( HB 2521 [[link removed]] / SB 6557 [[link removed]] ) this session—and that bill has its first public hearing tomorrow (2/4) in the Senate Human Services Committee! Those who file their taxes with an ITIN (Individual Tax Identification Number) are often immigrants, some visa holders, and survivors of domestic violence. All ITIN filers pay taxes on the wages they earn. ITIN filers who are income-eligible to receive the WFTC should also be allowed to receive this important anti-poverty benefit.

We’re calling on community advocates to urge their lawmakers to pass the ITIN expansion bill and fund/modernize the Working Families Tax Credit this year. Send an email today so lawmakers receive it in time for the hearing tomorrow!

Modernize and fund the WFTC! [[link removed]]

Connect With Us:Facebook [#] Contact Info:Statewide Poverty Action Network

1501 N 45th Street

Seattle, WA 98103

United States

Twitter [#]

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

We have recently moved to a new data system, please let us know if you are experiencing any issues with our new system.

Message Analysis

- Sender: Poverty Action

- Political Party: n/a

- Country: United States

- State/Locality: Washington

- Office: n/a

-

Email Providers:

- EveryAction