Email

Tax Professional Tip #16 – Understanding income tax penalties and interest rates

| From | Minnesota Department of Revenue <[email protected]> |

| Subject | Tax Professional Tip #16 – Understanding income tax penalties and interest rates |

| Date | April 20, 2023 3:06 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Tax professionals

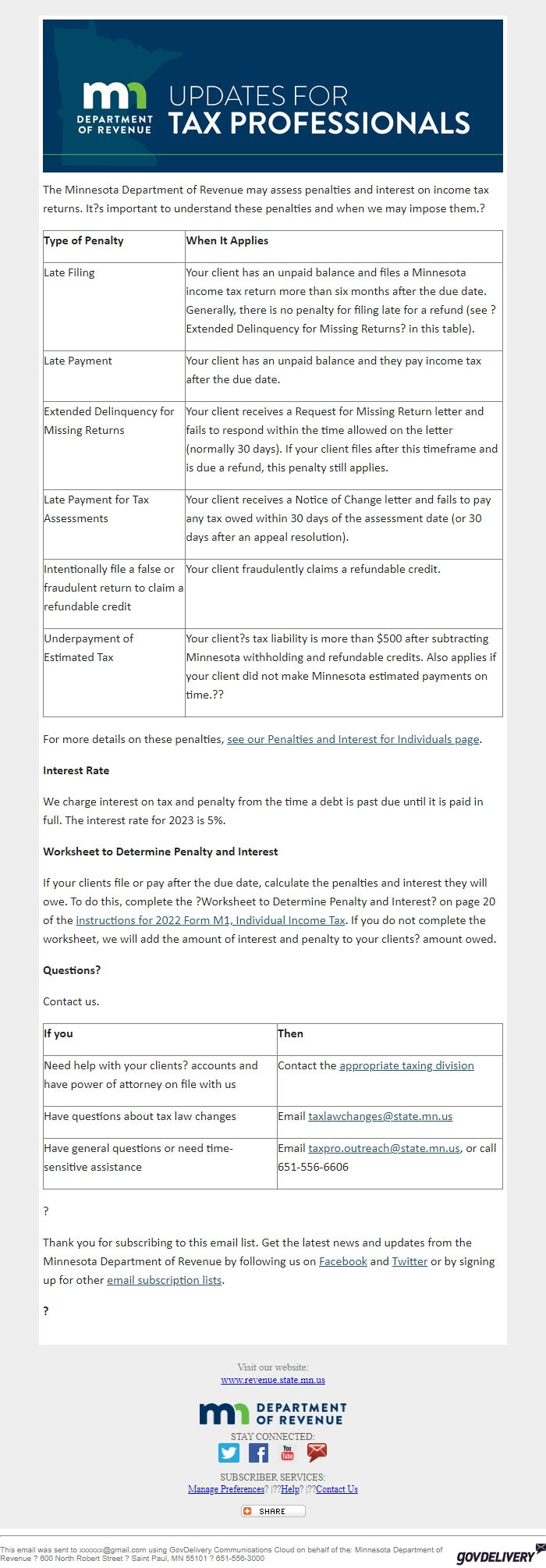

The Minnesota Department of Revenue may assess penalties and interest on income tax returns. It?s important to understand these penalties and when we may impose them.?

*Type of Penalty*

*When It Applies*

Late Filing

Your client has an unpaid balance and files a Minnesota income tax return more than six months after the due date. Generally, there is no penalty for filing late for a refund (see ?Extended Delinquency for Missing Returns? in this table).

Late Payment

Your client has an unpaid balance and they pay income tax after the due date.

Extended Delinquency for Missing Returns

Your client receives a Request for Missing Return letter and fails to respond within the time allowed on the letter (normally 30 days). If your client files after this timeframe and is due a refund, this penalty still applies.

Late Payment for Tax Assessments

Your client receives a Notice of Change letter and fails to pay any tax owed within 30 days of the assessment date (or 30 days after an appeal resolution).

Intentionally file a false or fraudulent return to claim a refundable credit

Your client fraudulently claims a refundable credit.

Underpayment of Estimated Tax

Your client?s tax liability is more than $500 after subtracting Minnesota withholding and refundable credits. Also applies if your client did not make Minnesota estimated payments on time.??

For more details on these penalties, see our Penalties and Interest for Individuals page [ [link removed] ].

*Interest Rate*

We charge interest on tax and penalty from the time a debt is past due until it is paid in full. The interest rate for 2023 is 5%.

*Worksheet to Determine Penalty and Interest*

If your clients file or pay after the due date, calculate the penalties and interest they will owe. To do this, complete the ?Worksheet to Determine Penalty and Interest? on page 20 of the instructions for 2022 Form M1, Individual Income Tax [ [link removed] ]. If you do not complete the worksheet, we will add the amount of interest and penalty to your clients? amount owed.

*Questions?*

Contact us.

*If you*

*Then*

Need help with your clients? accounts and have power of attorney on file with us

Contact the appropriate taxing division [ [link removed] ]

Have questions about tax law changes

Email [email protected]

Have general questions or need time-sensitive assistance

Email [email protected], or call 651-556-6606

?

Thank you for subscribing to this email list. Get the latest news and updates from the Minnesota Department of Revenue by following us on Facebook [ [link removed] ] and Twitter [ [link removed] ] or by signing up for other email subscription lists [ [link removed] ].

*?*

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ]? |??Help [ [link removed] ]? |??Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue ? 600 North Robert Street ? Saint Paul, MN 55101 ? 651-556-3000 GovDelivery logo [ [link removed] ]

The Minnesota Department of Revenue may assess penalties and interest on income tax returns. It?s important to understand these penalties and when we may impose them.?

*Type of Penalty*

*When It Applies*

Late Filing

Your client has an unpaid balance and files a Minnesota income tax return more than six months after the due date. Generally, there is no penalty for filing late for a refund (see ?Extended Delinquency for Missing Returns? in this table).

Late Payment

Your client has an unpaid balance and they pay income tax after the due date.

Extended Delinquency for Missing Returns

Your client receives a Request for Missing Return letter and fails to respond within the time allowed on the letter (normally 30 days). If your client files after this timeframe and is due a refund, this penalty still applies.

Late Payment for Tax Assessments

Your client receives a Notice of Change letter and fails to pay any tax owed within 30 days of the assessment date (or 30 days after an appeal resolution).

Intentionally file a false or fraudulent return to claim a refundable credit

Your client fraudulently claims a refundable credit.

Underpayment of Estimated Tax

Your client?s tax liability is more than $500 after subtracting Minnesota withholding and refundable credits. Also applies if your client did not make Minnesota estimated payments on time.??

For more details on these penalties, see our Penalties and Interest for Individuals page [ [link removed] ].

*Interest Rate*

We charge interest on tax and penalty from the time a debt is past due until it is paid in full. The interest rate for 2023 is 5%.

*Worksheet to Determine Penalty and Interest*

If your clients file or pay after the due date, calculate the penalties and interest they will owe. To do this, complete the ?Worksheet to Determine Penalty and Interest? on page 20 of the instructions for 2022 Form M1, Individual Income Tax [ [link removed] ]. If you do not complete the worksheet, we will add the amount of interest and penalty to your clients? amount owed.

*Questions?*

Contact us.

*If you*

*Then*

Need help with your clients? accounts and have power of attorney on file with us

Contact the appropriate taxing division [ [link removed] ]

Have questions about tax law changes

Email [email protected]

Have general questions or need time-sensitive assistance

Email [email protected], or call 651-556-6606

?

Thank you for subscribing to this email list. Get the latest news and updates from the Minnesota Department of Revenue by following us on Facebook [ [link removed] ] and Twitter [ [link removed] ] or by signing up for other email subscription lists [ [link removed] ].

*?*

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ]? |??Help [ [link removed] ]? |??Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue ? 600 North Robert Street ? Saint Paul, MN 55101 ? 651-556-3000 GovDelivery logo [ [link removed] ]

Message Analysis

- Sender: Minnesota Department of Revenue

- Political Party: n/a

- Country: United States

- State/Locality: Minnesota

- Office: n/a

-

Email Providers:

- govDelivery