Email

Easy money economics is a disaster – update from your favorite think tank

| From | Douglas Carswell <[email protected]> |

| Subject | Easy money economics is a disaster – update from your favorite think tank |

| Date | April 15, 2023 12:44 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View this email in your browser ([link removed])

Dear Jack,

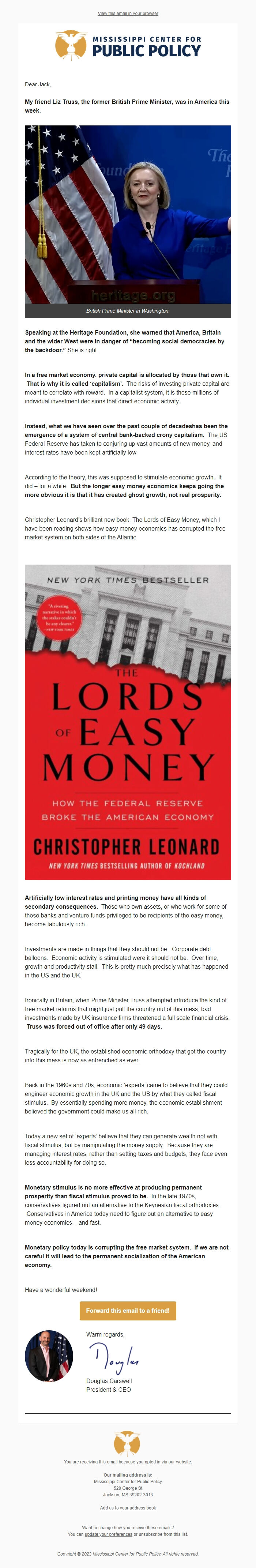

My friend Liz Truss, the former British Prime Minister, was in America this week.

British Prime Minister in Washington.

Speaking at the Heritage Foundation, she warned that America, Britain and the wider West were in danger of “becoming social democracies by the backdoor.” She is right.

In a free market economy, private capital is allocated by those that own it. That is why it is called ‘capitalism’. The risks of investing private capital are meant to correlate with reward. In a capitalist system, it is these millions of individual investment decisions that direct economic activity.

Instead, what we have seen over the past couple of decadeshas been the emergence of a system of central bank-backed crony capitalism. The US Federal Reserve has taken to conjuring up vast amounts of new money, and interest rates have been kept artificially low.

According to the theory, this was supposed to stimulate economic growth. It did – for a while. But the longer easy money economics keeps going the more obvious it is that it has created ghost growth, not real prosperity.

Christopher Leonard’s brilliant new book, The Lords of Easy Money, which I have been reading shows how easy money economics has corrupted the free market system on both sides of the Atlantic.

Artificially low interest rates and printing money have all kinds of secondary consequences. Those who own assets, or who work for some of those banks and venture funds privileged to be recipients of the easy money, become fabulously rich.

Investments are made in things that they should not be. Corporate debt balloons. Economic activity is stimulated were it should not be. Over time, growth and productivity stall. This is pretty much precisely what has happened in the US and the UK.

Ironically in Britain, when Prime Minister Truss attempted introduce the kind of free market reforms that might just pull the country out of this mess, bad investments made by UK insurance firms threatened a full scale financial crisis. Truss was forced out of office after only 49 days.

Tragically for the UK, the established economic orthodoxy that got the country into this mess is now as entrenched as ever.

Back in the 1960s and 70s, economic ‘experts’ came to believe that they could engineer economic growth in the UK and the US by what they called fiscal stimulus. By essentially spending more money, the economic establishment believed the government could make us all rich.

Today a new set of ‘experts’ believe that they can generate wealth not with fiscal stimulus, but by manipulating the money supply. Because they are managing interest rates, rather than setting taxes and budgets, they face even less accountability for doing so.

Monetary stimulus is no more effective at producing permanent prosperity than fiscal stimulus proved to be. In the late 1970s, conservatives figured out an alternative to the Keynesian fiscal orthodoxies. Conservatives in America today need to figure out an alternative to easy money economics – and fast.

Monetary policy today is corrupting the free market system. If we are not careful it will lead to the permanent socialization of the American economy.

Have a wonderful weekend!

Forward this email to a friend! ([link removed])

Warm regards,

Douglas Carswell

President & CEO

============================================================

You are receiving this email because you opted in via our website.

Our mailing address is:

Mississippi Center for Public Policy

520 George St

Jackson, MS 39202-3013

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Copyright © 2023 Mississippi Center for Public Policy, All rights reserved.

Dear Jack,

My friend Liz Truss, the former British Prime Minister, was in America this week.

British Prime Minister in Washington.

Speaking at the Heritage Foundation, she warned that America, Britain and the wider West were in danger of “becoming social democracies by the backdoor.” She is right.

In a free market economy, private capital is allocated by those that own it. That is why it is called ‘capitalism’. The risks of investing private capital are meant to correlate with reward. In a capitalist system, it is these millions of individual investment decisions that direct economic activity.

Instead, what we have seen over the past couple of decadeshas been the emergence of a system of central bank-backed crony capitalism. The US Federal Reserve has taken to conjuring up vast amounts of new money, and interest rates have been kept artificially low.

According to the theory, this was supposed to stimulate economic growth. It did – for a while. But the longer easy money economics keeps going the more obvious it is that it has created ghost growth, not real prosperity.

Christopher Leonard’s brilliant new book, The Lords of Easy Money, which I have been reading shows how easy money economics has corrupted the free market system on both sides of the Atlantic.

Artificially low interest rates and printing money have all kinds of secondary consequences. Those who own assets, or who work for some of those banks and venture funds privileged to be recipients of the easy money, become fabulously rich.

Investments are made in things that they should not be. Corporate debt balloons. Economic activity is stimulated were it should not be. Over time, growth and productivity stall. This is pretty much precisely what has happened in the US and the UK.

Ironically in Britain, when Prime Minister Truss attempted introduce the kind of free market reforms that might just pull the country out of this mess, bad investments made by UK insurance firms threatened a full scale financial crisis. Truss was forced out of office after only 49 days.

Tragically for the UK, the established economic orthodoxy that got the country into this mess is now as entrenched as ever.

Back in the 1960s and 70s, economic ‘experts’ came to believe that they could engineer economic growth in the UK and the US by what they called fiscal stimulus. By essentially spending more money, the economic establishment believed the government could make us all rich.

Today a new set of ‘experts’ believe that they can generate wealth not with fiscal stimulus, but by manipulating the money supply. Because they are managing interest rates, rather than setting taxes and budgets, they face even less accountability for doing so.

Monetary stimulus is no more effective at producing permanent prosperity than fiscal stimulus proved to be. In the late 1970s, conservatives figured out an alternative to the Keynesian fiscal orthodoxies. Conservatives in America today need to figure out an alternative to easy money economics – and fast.

Monetary policy today is corrupting the free market system. If we are not careful it will lead to the permanent socialization of the American economy.

Have a wonderful weekend!

Forward this email to a friend! ([link removed])

Warm regards,

Douglas Carswell

President & CEO

============================================================

You are receiving this email because you opted in via our website.

Our mailing address is:

Mississippi Center for Public Policy

520 George St

Jackson, MS 39202-3013

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Copyright © 2023 Mississippi Center for Public Policy, All rights reserved.

Message Analysis

- Sender: Mississippi Center for Public Policy

- Political Party: n/a

- Country: United States

- State/Locality: Mississippi

- Office: n/a

-

Email Providers:

- MailChimp