April 13, 2023

Permission to republish original opeds and cartoons granted.

Inflation dips to 5 percent as demand begins collapsing, Fed set to keep increasing

By Robert Romano

The consumer price index has continued to descend from its June 2022 peak of 9.1 percent down to a still elevated 5 percent in March 2023, according to the latest reading from the Bureau of Labor Statistics.

The decrease was almost exclusively due energy prices continuing to stabilize, with oil prices being down in March, with gasoline down 4.6 percent and fuel oil down 4 percent in just a month.

Electricity was down 0.7 percent and piped gas service was down another 7.1 percent in March, following an 8 percent drop in February.

But that was before OPEC+ slashed production in early April, which has seen light sweet crude oil rise from about $67 a barrel in late March to now about $83 a barrel in April, a 24 percent increase that will surely find its way to gas prices over the next several weeks.

The production cut was predicated on anticipated weaker demand, and so over the longer term prices could wind up dropping anyway.

However, the sudden rise in oil prices could serve notice on the Federal Reserve that inflation pressures due to supply issues are still very much an issue, as much as the $6 trillion that was printed, borrowed and spent for Covid is, which came at a time of production halts, economic lockdowns and paying people to stay home.

The M2 money supply increased dramatically from $15.3 trillion in Feb. 2020 to a peak of $22 trillion by April 2022, a massive 43.7 percent, leading to the inflation spike, where consumer inflation reached 9.1 percent in June 2022. By the time Russia invaded Ukraine in Feb. 2022—further worsening global supply issues—consumer inflation was already north of 7.5 percent. The M2 money supply has now decreased a bit to $21.1 trillion.

On March 22, the Federal Reserve noted that continued increases of the Federal Funds Rate, or “additional policy firming,” could be on the horizon, stating, “the Committee decided to raise the target range for the federal funds rate to 4-3/4 to 5 percent. The Committee will closely monitor incoming information and assess the implications for monetary policy. The Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.”

The central bank added, “In determining the extent of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

In just a year, the Fed has gone from 0.08 percent in Feb. 2022 on the effective Federal Funds Rate — at which point inflation was already 7.5 percent — to now 4.65 percent in March, leading to much hand-wringing on Wall Street about interest rates rising faster than ever.

To be certain, it is one of the quicker paces of increases of the Federal Funds Rate in recent memory, looking a bit further back in history, it looks a lot like the rate increases that combated the inflation of the 1970s and 1980s.

For example, in 1981, when the effective Federal Funds Rate rose from 14.7 percent in March 1981 to 19.1 percent in June 1981, a 4.4 percent increase.

That was dwarfed by 1980, when rose from about 9 percent in July 1980 to 19.1 percent in Jan. 1981, a 10.1 percent increase.

Or in 1979, when it rose from about 10.1 percent in April 1979 to about 17.6 percent in April 1980, a 7.5 percent increase.

Or 1973, hen it rose from Sept. 1972 to Sept. 1973, from about 4.9 percent to 10.8 percent, a 5.9 percent increase.

Those were rocky times, too, but what the Fed is doing is by no means unprecedented. What was unprecedented was printing $6 trillion and simultaneously shutting the economy down and reducing production—too much money chasing too few goods.

The Fed’s rate hikes come as 10-year treasuries remain at about 3.37 percent of this writing, and 30-year mortgage interest rates are at about 6.3 percent as existing home sales remain down about 22.6 percent from their 2022 highs a year ago, according to the National Association of Realtors.

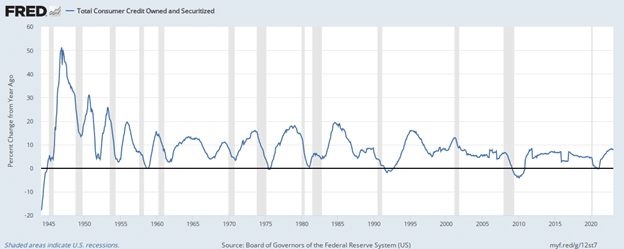

The news comes as the annual growth of consumer credit appears to have peaked at 8.1 percent in Oct. 2022, flattening slightly to 7.8 percent annualized by Dec. 2022 and then ticked up to 7.9 percent Jan. 2023 and now is down to 7.6 percent in Feb. 2023, which could be a sign of weakening demand. Usually, it peaks just before or at the beginning recessions, and then will slow down significantly once unemployment begins rising.

Either way, a slowdown in the growth of consumer credit could indicate American households are maxing out on their credit cards, which will have a dampening effect on demand going forward.

And yet, unemployment remains at historic lows of 3.5 percent, and with the Fed projecting a 4.6 percent unemployment rate in 2024, as many as 2 million job losses still appear to remain on the horizon, meaning there’s still room for the Fed move rates higher. To be certain at 5 percent inflation, it would only take another quarter point hike or so to get the Fed’s interest rate above that of the consumer inflation rate. Stay tuned.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

To view online: https://dailytorch.com/2023/04/inflation-dips-to-5-percent-as-demand-begins-collapsing-fed-set-to-keep-increasing/

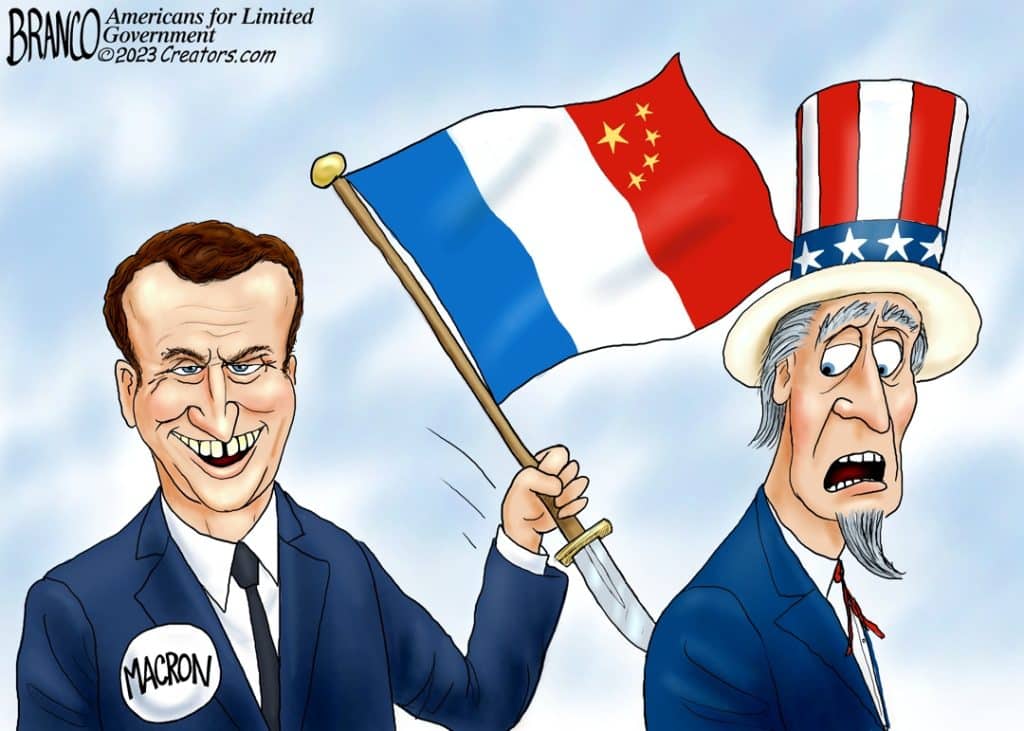

Cartoon: French Fried

By A.F. Branco

Click here for a higher level resolution version.

To view online: https://dailytorch.com/2023/04/cartoon-french-fried/

China’s WAR? DUMPS $150 Billion U.S. Treasuries! Dollar’s END??

To view online: https://www.youtube.com/watch?v=Fmgps4mrKwc

How House Republicans Have Used Their Majority so Far

By Mark Tapscott

When President Joe Biden on April 10 signed into law a House Republican-initiated measure ending the national emergency enacted in 2020 in response to the pandemic, it marked the second time he has approved a bill launched in the Republican-led lower chamber of Congress.

Democrats retained control of the Senate after the 2022 midterms, leading to widespread doubt about whether the Republican-led House of Representatives would see any bill it passed become law. But that’s not how things have gone in the three months since the 118th Congress convened.

In addition to the two Republican-initiated bills which Biden signed, McCarthy and the GOP leadership team, working with a thin 222–213 majority have succeeded in passing six of the 11 major bills party leaders promised just before the 118th Congress first convened on Jan. 3. They also celebrated the Senate passage of a bill blocking Biden’s Waters of the United States proposal before the president vetoed the bill April 6.

Dozens of Republican elected officials, party activists, advocates, and campaign strategists have told The Epoch Times that House Republicans are dealing with major challenges but expressed enthusiasm for what has nevertheless been accomplished in less than three months. All expect much more from the party, especially in the fall when the biggest legislative battles will be fought.

Tom Schatz, president of Citizens Against Government Waste, told The Epoch Times he is encouraged by how House Republican leaders are shining light in areas of the federal bureaucracy that were mostly ignored under the previous Congress.

“Taxpayers should be relieved that House committees have been holding oversight hearings to increase accountability and transparency, which was severely lacking over the past two years. House leadership asked each committee to establish an oversight plan, which again did not occur when Democrats were in charge,” Schatz said.

But Schatz added that GOP House leaders “should expand on that effort, especially since estimates vary on how much of this money was stolen, misused, or subject to improper payments.”

Similarly, Americans for Tax Reform President Grover Norquist gave high marks to McCarthy and company for avoiding the infighting that was widely predicted by the mainstream media to erupt within House GOP ranks.

“The Republican House-led investigations and subpoenas are building a case against Democrat rule in the White House and bureaucracy. The narrow GOP majority has held together on tough issues like parental rights,” Norquest told The Epoch Times.

“Both ‘wings’ of the GOP—Northeastern moderates and deep red state MAGA types—are learning how to vote together to get ‘good but not perfect’ bills to 218 votes.”

McCarthy’s Leadership

A key factor in that cohesion, according to Rep. Andy Ogles (R-Tenn.), has been the inclusive approach taken by House GOP leaders. Ogles attributed much of the expected divisions within the House GOP conference to “the media inflating some of the friction that was there. But all parties were talking into the wee hours of the morning to come up with solutions.”

Ogles was one of the 20 House Republicans who achieved major conservative reforms in House procedures during the standoff over McCarthy’s speakership vote.

“Everybody understood, leadership was very respectful, we sat across the table saying this is what we’re looking for, this is what I came to Congress for, and they said ‘ok, let’s see if we can get there,’ so there was this very thoughtful process,” he said.

Ogles also recalled his recent lengthy conversation with Emmer about the debt ceiling issue that is expected to prompt a landmark debate in coming months between House Republicans, Biden, and Senate Democrats.

“We had a long conversation to get my input, I mean here I am just a freshman, a low man on the totem pole, but he’s getting my thoughts on the debt ceiling. They have really done a great job of including all voices in these big discussions,” Ogles said.

David Williams, president of the Taxpayers Protection Alliance, told The Epoch Times he thinks House Republicans can and should make major progress in cutting the IRS down to size. Doing so will require more bipartisan cooperation.

“With the new-found majority, this is the time to put aside partisan politics and look for areas where there is common ground such as IRS reform. The IRS has historically targeted low-income taxpayers for audits from both parties. Reining in an abusive and intrusive IRS is an excellent start,” Williams said.

Overall, the House GOP majority has chalked up some wins but the biggest battles are still ahead, according to Potomac Strategy Group President Matt Mackowiak.

“The GOP House majority had a slow start after multiple rounds of voting for Speaker, but they are starting to find their footing, they are enacting their agenda and have passed bills that President Biden has signed,” said Mackowiak, a Capitol Hill aide-turned national campaign strategist.

“The real heavy lifting is ahead on the debt ceiling and government funding,” he said. Asked how he rates the chances that McCarthy and Biden can reach an agreement on raising the debt ceiling from its present $31.4 trillion along with major reforms needed to get federal spending under control, Mackowiak replied “I think it’s going to be really tough.”

Debt Ceiling is Key Issue

Americans for Limited Government (ALG) President Richard Manning also sees the debt ceiling issue as central to House Republicans’ chances for success, but he doesn’t think the man in the Oval Office is nearly as critical.

“The speaker needs to get a debt limit increase bill on the floor that limits or cuts spending now. He should send something to the Senate and make it their problem. Biden won’t talk, but, truthfully, who cares what he says, this is between the House and the Senate and Biden can decide whether to default on the debt by vetoing or not,” Manning explained.

“Obviously Biden would be involved on the Senate side, but let them explain why we need to continue down the path of fiscal destruction versus taking a reasonable step toward slowing the growth of government spending,” he added.

Manning also acknowledged that Republicans will have to compromise, but so will Democrats.

“Basically, McCarthy needs to pass a [debt ceiling/spending cut] bill to set a marker, and, with the limited majority, it won’t be what I would want, but if it just accomplishes some restraint, it will be very hard for the Left to oppose it. I would also put at least 10 spending cut/policy riders in the bill that the Democrats can focus on with the idea of making the negotiation about the riders rather than the basic bill framework,” Manning continued.

Republican strategist Brian Darling, a Capitol Hill veteran and founder of Liberty Government Affairs (LGA), thinks McCarthy has “a great opportunity to leverage a similar deal that Speaker of the House John Boehner and President Barack Obama cut back in 2011. Republicans took a hard line and supported ‘Cut, Cap and, Balance’ and that led to chain of events leading to something called the Sequester, a mechanism to automatically cut spending across the board for discretionary programs. A similar deal to the 2011 deal would be optimal.”

Darling was referring to the Budget Control Act of 2011 that incorporated much of the Cut, Cap, and Balance Act of 2011 proposal sponsored by then-Rep. Jason Chaffetz (R-Utah).

Besides the debt ceiling, the growing imposition by the government at all levels of “woke” social policies, especially in the Department of Defense (DOD), requires more action by House Republicans, according to many of those interviewed by The Epoch Times.

For example, Mike Berry, First Liberty Institute’s Vice-President for External Affairs and Director of Military Affairs, said the woke problem within DOD began under President Barack Obama and is accelerating under Biden.

Woke Won’t Win Wars

“What we’re doing is, our military is defunding tanks, we’re getting rid of snipers in the Marine Corps and instead, we’re funding Diversity, Equity, Inclusion (CEI) programs, we’re funding drag queen story hours in DOD schools,” Berry pointed out.

“There need to be hearings, I would say, to call those Pentagon officials to the Hill to testify, to explain. ‘Look, just tell me if you can give me a good argument for why getting rid of tanks is good for our national security, Okay, I am willing to listen. Or why label evangelicals and Catholics as extremists? If you can give me something to support that, then I am willing to listen.’ But they can’t and they refuse to, they obfuscate, they delay, they obstruct. That’s what I would like to see more of in the House,” Berry continued.

Asked if woke ideological fanaticism in the DOD is an issue of sufficient importance that he would favor House Republicans drawing a red line on funding, Berry responded that he believes “the American people are encouraged when they see their elected leaders stand on principle and not just be pragmatists all the time. There is a time for pragmatism but I don’t think principled constitutionalism should ever give way to pragmatism.”

Regarding the overall trend of American politics since the GOP regained control of the House in 2022, National Republican campaign strategist Jimmy Keady expressed optimism as a result of the House GOP majority.

“Republicans have had the majority for just three months now and they’re already beginning to alter the course of Biden’s agenda. They’ve been able to pass meaningful legislation that counters the agenda of the left,” he said.

“In North Carolina, we saw a state representative switch parties with more likely to come. We are seeing Kirsten Sinema becoming an Independent in Arizona too. Republicans across the country are proactively expanding their base and proving to be an electoral force heading into 2024. Speaker McCarthy and Republicans are proving that even with the slim majority in the House, they are able to be a check on President Biden’s power,” he said.

The critical measure of how the House Republican majority approaches its tasks going forward, according to Mike Howell, Director of the Heritage Foundation’s Oversight Project, is how much more accountable the federal government will be as a result.

“The most important thing the House can do this year is vigorous oversight and accountability. Americans are living through a time of corruption like we’ve never seen before. The House majority has a mandate to tell that story,” Howell told The Epoch Times. Howell is a former oversight counsel for committees of both chambers of Congress.

“Whether it’s the Black Lives Matter rioters who burned down significant portions of the country, the FBI which has turned into a grandma chasing agency, the payments the Biden Family so willingly took, or our unfair and unfree election system, the House should operate with an all gas no breaks mentality to seek true and lasting accountability. That’s the test by which we will judge the effectiveness of oversight,” Howell said.

To view online: https://www.theepochtimes.com/how-house-republicans-have-used-their-majority-so-far_5186605.html