Email

IR-2023-79: Time running out to claim $1.5 billion in refunds for tax year 2019, taxpayers face July 17 deadline

| From | IRS Newswire <[email protected]> |

| Subject | IR-2023-79: Time running out to claim $1.5 billion in refunds for tax year 2019, taxpayers face July 17 deadline |

| Date | April 12, 2023 6:08 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;}

IRS.gov Banner

IRS Newswire April 12, 2023

News Essentials

What's Hot [ [link removed] ]

News Releases [ [link removed] ]

IRS - The Basics [ [link removed] ]

IRS Guidance [ [link removed] ]

Media Contacts [ [link removed] ]

Facts & Figures [ [link removed] ]

Around The Nation [ [link removed] ]

e-News Subscriptions [ [link removed] ]

________________________________________________________________________

The Newsroom Topics

Multimedia Center [ [link removed] ]

Noticias en Español [ [link removed] ]

Radio PSAs [ [link removed] ]

Tax Scams [ [link removed] ]

The Tax Gap [ [link removed] ]

Fact Sheets [ [link removed] ]

IRS Tax Tips [ [link removed] ]

Armed Forces [ [link removed] ]

Latest News Home [ [link removed] ]

________________________________________________________________________

IRS Resources

Contact My Local Office [ [link removed] ]

Filing Options [ [link removed] ]

Forms & Instructions [ [link removed] ]

Frequently Asked Questions [ [link removed] ]

News [ [link removed] ]

Taxpayer Advocate [ [link removed] ]

Where to File [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

*Issue Number:* IR-2023-79

*Inside This Issue*

________________________________________________________________________

*Time running out to claim $1.5 billion in refunds for tax year 2019, taxpayers face July 17 deadline*

WASHINGTON ― The Internal Revenue Service announced today that nearly 1.5 million people across the nation have unclaimed refunds for tax year 2019 but face a July 17 deadline to submit their tax return.

The IRS estimates almost $1.5 billion in refunds remain unclaimed because people haven’t filed their 2019 tax returns yet. The average median refund is $893 for this year, and the IRS has done a special state-by-state calculation to show how many people are potentially eligible for these refunds.

“The 2019 tax returns came due during the pandemic, and many people may have overlooked or forgotten about these refunds,” said IRS Commissioner Danny Werfel. “We want taxpayers to claim these refunds, but time is running out. People face a July 17 deadline to file their returns. We recommend taxpayers start soon to make sure they don’t miss out.”

Under the law, taxpayers usually have three years to file and claim their tax refunds. If they don't file within three years, the money becomes the property of the U.S. Treasury.

But for 2019 tax returns, people have more time than usual to file to claim their refunds. Usually, the normal filing deadline to claim old refunds falls around the April tax deadline, which is April 18 this year for 2022 tax returns. But the three-year window for 2019 unfiled returns was postponed to July 17, 2023, due to the COVID-19 pandemic emergency. The IRS issued Notice 2023-21 [ [link removed] ] on Feb. 27, 2023, providing legal guidance on claims made by the postponed deadline.

The IRS estimates the midpoint for the potential unclaimed refunds for 2019 to be $893. That means half of the refunds are more than $893 and half are less.

“With the pandemic taking place when the 2019 tax returns were originally due, people faced extremely unusual situations. People may have simply forgotten about tax refunds with the deadline that year postponed all the way into July,” Werfel said. “We frequently see students, part-time workers and others with little income overlook filing a tax return and never realize they may be owed a refund. We encourage people to review their records and start gathering records now, so they don’t run the risk of missing the July deadline.”

By missing out on filing a tax return, people stand to lose more than just their refund of taxes withheld or paid during 2019. Many low- and moderate-income workers may be eligible for the Earned Income Tax Credit (EITC). For 2019, the credit was worth as much as $6,557. The EITC helps individuals and families whose incomes are below certain thresholds in 2019. Those who are potentially eligible for EITC in 2019 had incomes below:

* $50,162 ($55,952 if married filing jointly) for those with three or more qualifying children;

* $46,703 ($52,493 if married filing jointly) for people with two qualifying children;

* $41,094 ($46,884 if married filing jointly) for those with one qualifying child, and;

* $15,570 ($21,370 if married filing jointly) for people without qualifying children.

The IRS reminds taxpayers seeking a 2019 tax refund that their checks may be held if they have not filed tax returns for 2020 and 2021. In addition, the refund will be applied to any amounts still owed to the IRS or a state tax agency and may be used to offset unpaid child support or past due federal debts, such as student loans.

Current and prior year tax forms (such as the tax year 2019 Forms 1040 and 1040-SR) and instructions are available on the IRS.gov Forms and Publications [ [link removed] ] page or by calling toll-free 800-TAX-FORM (800-829-3676).

*Need to file a 2019 tax return? Several options to get key documents*

Although it’s been several years since 2019, the IRS reminds taxpayers there are ways they can still gather the information they need to file this tax return. But people should start early to make sure they have enough time to file before the July deadline for 2019 refunds. Here are some options:

* *Request copies of key documents:* Taxpayers who are missing Forms W-2, 1098, 1099 or 5498 for the years 2019, 2020 or 2021 can request copies from their employer, bank or other payers.

* *Use Get Transcript Online [ [link removed] ] at IRS.gov.* Taxpayers who are unable to get those missing forms from their employer or other payers can order a free wage and income transcript at IRS.gov using the Get Transcript Online tool. For many taxpayers, this is by far the quickest and easiest option.

* *Or request a transcript.* Another option is for people to file Form 4506-T [ [link removed] ] with the IRS to request a “wage and income transcript.” A wage and income transcript shows data from information returns received by the IRS, such as Forms W-2, 1099, 1098, Form 5498 and IRA contribution information. Taxpayers can use the information from the transcript to file their tax return. But plan ahead – these written requests can take several weeks; people are strongly urged to try the other options first.

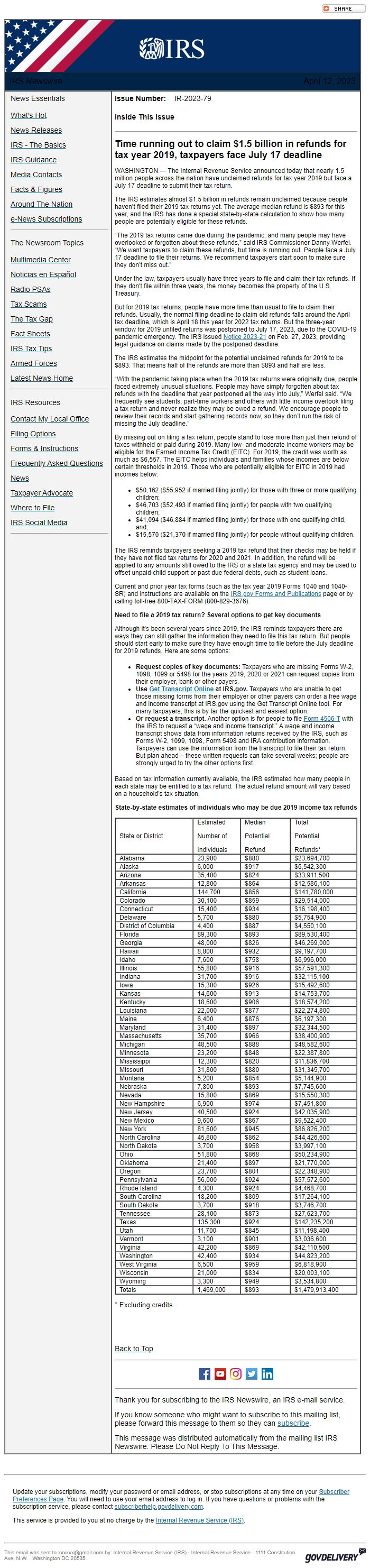

Based on tax information currently available, the IRS estimated how many people in each state may be entitled to a tax refund. The actual refund amount will vary based on a household’s tax situation.

*State-by-state estimates of individuals who may be due 2019 income tax refunds*

State or District

Estimated

Number of

Individuals

Median

Potential

Refund

Total

Potential

Refunds*

Alabama

23,900

$880

$23,694,700

Alaska

6,000

$917

$6,542,300

Arizona

35,400

$824

$33,911,500

Arkansas

12,800

$864

$12,586,100

California

144,700

$856

$141,780,000

Colorado

30,100

$859

$29,514,000

Connecticut

15,400

$934

$16,198,400

Delaware

5,700

$880

$5,754,900

District of Columbia

4,400

$887

$4,550,100

Florida

89,300

$893

$89,530,400

Georgia

48,000

$826

$46,269,000

Hawaii

8,800

$932

$9,197,700

Idaho

7,600

$758

$6,996,000

Illinois

55,800

$916

$57,591,300

Indiana

31,700

$916

$32,115,100

Iowa

15,300

$926

$15,492,600

Kansas

14,600

$913

$14,753,700

Kentucky

18,600

$906

$18,574,200

Louisiana

22,000

$877

$22,274,800

Maine

6,400

$876

$6,197,300

Maryland

31,400

$897

$32,344,500

Massachusetts

35,700

$966

$38,400,900

Michigan

48,500

$888

$48,582,600

Minnesota

23,200

$848

$22,387,800

Mississippi

12,300

$820

$11,836,700

Missouri

31,800

$880

$31,345,700

Montana

5,200

$854

$5,144,900

Nebraska

7,800

$893

$7,745,600

Nevada

15,800

$869

$15,550,300

New Hampshire

6,900

$974

$7,451,800

New Jersey

40,500

$924

$42,035,900

New Mexico

9,600

$867

$9,522,400

New York

81,600

$945

$86,826,200

North Carolina

45,800

$862

$44,426,600

North Dakota

3,700

$958

$3,997,100

Ohio

51,800

$868

$50,234,900

Oklahoma

21,400

$897

$21,770,000

Oregon

23,700

$801

$22,348,900

Pennsylvania

56,000

$924

$57,572,600

Rhode Island

4,300

$924

$4,468,700

South Carolina

18,200

$809

$17,264,100

South Dakota

3,700

$918

$3,746,700

Tennessee

28,100

$873

$27,623,700

Texas

135,300

$924

$142,235,200

Utah

11,700

$845

$11,198,400

Vermont

3,100

$901

$3,036,600

Virginia

42,200

$869

$42,110,500

Washington

42,400

$934

$44,823,200

West Virginia

6,500

$959

$6,818,900

Wisconsin

21,000

$834

$20,003,100

Wyoming

3,300

$949

$3,534,800

Totals

1,469,000

$893

$1,479,913,400

* Excluding credits.

Back to Top [ #Fifteenth ]

________________________________________________________________________

FaceBook Logo [ [link removed] ] YouTube Logo [ [link removed] ] Instagram Logo [ [link removed] ] Twitter Logo [ [link removed] ] LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to the IRS Newswire, an IRS e-mail service.

If you know someone who might want to subscribe to this mailing list, please forward this message to them so they can subscribe [ [link removed] ].

This message was distributed automatically from the mailing list IRS Newswire. Please Do Not Reply To This Message.

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need to use your email address to log in. If you have questions or problems with the subscription service, please contact subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) · Internal Revenue Service · 1111 Constitution Ave. N.W. · Washington DC 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

a { color:#0073AF !important;} a:hover { color:#004673 !important;}

IRS.gov Banner

IRS Newswire April 12, 2023

News Essentials

What's Hot [ [link removed] ]

News Releases [ [link removed] ]

IRS - The Basics [ [link removed] ]

IRS Guidance [ [link removed] ]

Media Contacts [ [link removed] ]

Facts & Figures [ [link removed] ]

Around The Nation [ [link removed] ]

e-News Subscriptions [ [link removed] ]

________________________________________________________________________

The Newsroom Topics

Multimedia Center [ [link removed] ]

Noticias en Español [ [link removed] ]

Radio PSAs [ [link removed] ]

Tax Scams [ [link removed] ]

The Tax Gap [ [link removed] ]

Fact Sheets [ [link removed] ]

IRS Tax Tips [ [link removed] ]

Armed Forces [ [link removed] ]

Latest News Home [ [link removed] ]

________________________________________________________________________

IRS Resources

Contact My Local Office [ [link removed] ]

Filing Options [ [link removed] ]

Forms & Instructions [ [link removed] ]

Frequently Asked Questions [ [link removed] ]

News [ [link removed] ]

Taxpayer Advocate [ [link removed] ]

Where to File [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

*Issue Number:* IR-2023-79

*Inside This Issue*

________________________________________________________________________

*Time running out to claim $1.5 billion in refunds for tax year 2019, taxpayers face July 17 deadline*

WASHINGTON ― The Internal Revenue Service announced today that nearly 1.5 million people across the nation have unclaimed refunds for tax year 2019 but face a July 17 deadline to submit their tax return.

The IRS estimates almost $1.5 billion in refunds remain unclaimed because people haven’t filed their 2019 tax returns yet. The average median refund is $893 for this year, and the IRS has done a special state-by-state calculation to show how many people are potentially eligible for these refunds.

“The 2019 tax returns came due during the pandemic, and many people may have overlooked or forgotten about these refunds,” said IRS Commissioner Danny Werfel. “We want taxpayers to claim these refunds, but time is running out. People face a July 17 deadline to file their returns. We recommend taxpayers start soon to make sure they don’t miss out.”

Under the law, taxpayers usually have three years to file and claim their tax refunds. If they don't file within three years, the money becomes the property of the U.S. Treasury.

But for 2019 tax returns, people have more time than usual to file to claim their refunds. Usually, the normal filing deadline to claim old refunds falls around the April tax deadline, which is April 18 this year for 2022 tax returns. But the three-year window for 2019 unfiled returns was postponed to July 17, 2023, due to the COVID-19 pandemic emergency. The IRS issued Notice 2023-21 [ [link removed] ] on Feb. 27, 2023, providing legal guidance on claims made by the postponed deadline.

The IRS estimates the midpoint for the potential unclaimed refunds for 2019 to be $893. That means half of the refunds are more than $893 and half are less.

“With the pandemic taking place when the 2019 tax returns were originally due, people faced extremely unusual situations. People may have simply forgotten about tax refunds with the deadline that year postponed all the way into July,” Werfel said. “We frequently see students, part-time workers and others with little income overlook filing a tax return and never realize they may be owed a refund. We encourage people to review their records and start gathering records now, so they don’t run the risk of missing the July deadline.”

By missing out on filing a tax return, people stand to lose more than just their refund of taxes withheld or paid during 2019. Many low- and moderate-income workers may be eligible for the Earned Income Tax Credit (EITC). For 2019, the credit was worth as much as $6,557. The EITC helps individuals and families whose incomes are below certain thresholds in 2019. Those who are potentially eligible for EITC in 2019 had incomes below:

* $50,162 ($55,952 if married filing jointly) for those with three or more qualifying children;

* $46,703 ($52,493 if married filing jointly) for people with two qualifying children;

* $41,094 ($46,884 if married filing jointly) for those with one qualifying child, and;

* $15,570 ($21,370 if married filing jointly) for people without qualifying children.

The IRS reminds taxpayers seeking a 2019 tax refund that their checks may be held if they have not filed tax returns for 2020 and 2021. In addition, the refund will be applied to any amounts still owed to the IRS or a state tax agency and may be used to offset unpaid child support or past due federal debts, such as student loans.

Current and prior year tax forms (such as the tax year 2019 Forms 1040 and 1040-SR) and instructions are available on the IRS.gov Forms and Publications [ [link removed] ] page or by calling toll-free 800-TAX-FORM (800-829-3676).

*Need to file a 2019 tax return? Several options to get key documents*

Although it’s been several years since 2019, the IRS reminds taxpayers there are ways they can still gather the information they need to file this tax return. But people should start early to make sure they have enough time to file before the July deadline for 2019 refunds. Here are some options:

* *Request copies of key documents:* Taxpayers who are missing Forms W-2, 1098, 1099 or 5498 for the years 2019, 2020 or 2021 can request copies from their employer, bank or other payers.

* *Use Get Transcript Online [ [link removed] ] at IRS.gov.* Taxpayers who are unable to get those missing forms from their employer or other payers can order a free wage and income transcript at IRS.gov using the Get Transcript Online tool. For many taxpayers, this is by far the quickest and easiest option.

* *Or request a transcript.* Another option is for people to file Form 4506-T [ [link removed] ] with the IRS to request a “wage and income transcript.” A wage and income transcript shows data from information returns received by the IRS, such as Forms W-2, 1099, 1098, Form 5498 and IRA contribution information. Taxpayers can use the information from the transcript to file their tax return. But plan ahead – these written requests can take several weeks; people are strongly urged to try the other options first.

Based on tax information currently available, the IRS estimated how many people in each state may be entitled to a tax refund. The actual refund amount will vary based on a household’s tax situation.

*State-by-state estimates of individuals who may be due 2019 income tax refunds*

State or District

Estimated

Number of

Individuals

Median

Potential

Refund

Total

Potential

Refunds*

Alabama

23,900

$880

$23,694,700

Alaska

6,000

$917

$6,542,300

Arizona

35,400

$824

$33,911,500

Arkansas

12,800

$864

$12,586,100

California

144,700

$856

$141,780,000

Colorado

30,100

$859

$29,514,000

Connecticut

15,400

$934

$16,198,400

Delaware

5,700

$880

$5,754,900

District of Columbia

4,400

$887

$4,550,100

Florida

89,300

$893

$89,530,400

Georgia

48,000

$826

$46,269,000

Hawaii

8,800

$932

$9,197,700

Idaho

7,600

$758

$6,996,000

Illinois

55,800

$916

$57,591,300

Indiana

31,700

$916

$32,115,100

Iowa

15,300

$926

$15,492,600

Kansas

14,600

$913

$14,753,700

Kentucky

18,600

$906

$18,574,200

Louisiana

22,000

$877

$22,274,800

Maine

6,400

$876

$6,197,300

Maryland

31,400

$897

$32,344,500

Massachusetts

35,700

$966

$38,400,900

Michigan

48,500

$888

$48,582,600

Minnesota

23,200

$848

$22,387,800

Mississippi

12,300

$820

$11,836,700

Missouri

31,800

$880

$31,345,700

Montana

5,200

$854

$5,144,900

Nebraska

7,800

$893

$7,745,600

Nevada

15,800

$869

$15,550,300

New Hampshire

6,900

$974

$7,451,800

New Jersey

40,500

$924

$42,035,900

New Mexico

9,600

$867

$9,522,400

New York

81,600

$945

$86,826,200

North Carolina

45,800

$862

$44,426,600

North Dakota

3,700

$958

$3,997,100

Ohio

51,800

$868

$50,234,900

Oklahoma

21,400

$897

$21,770,000

Oregon

23,700

$801

$22,348,900

Pennsylvania

56,000

$924

$57,572,600

Rhode Island

4,300

$924

$4,468,700

South Carolina

18,200

$809

$17,264,100

South Dakota

3,700

$918

$3,746,700

Tennessee

28,100

$873

$27,623,700

Texas

135,300

$924

$142,235,200

Utah

11,700

$845

$11,198,400

Vermont

3,100

$901

$3,036,600

Virginia

42,200

$869

$42,110,500

Washington

42,400

$934

$44,823,200

West Virginia

6,500

$959

$6,818,900

Wisconsin

21,000

$834

$20,003,100

Wyoming

3,300

$949

$3,534,800

Totals

1,469,000

$893

$1,479,913,400

* Excluding credits.

Back to Top [ #Fifteenth ]

________________________________________________________________________

FaceBook Logo [ [link removed] ] YouTube Logo [ [link removed] ] Instagram Logo [ [link removed] ] Twitter Logo [ [link removed] ] LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to the IRS Newswire, an IRS e-mail service.

If you know someone who might want to subscribe to this mailing list, please forward this message to them so they can subscribe [ [link removed] ].

This message was distributed automatically from the mailing list IRS Newswire. Please Do Not Reply To This Message.

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need to use your email address to log in. If you have questions or problems with the subscription service, please contact subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) · Internal Revenue Service · 1111 Constitution Ave. N.W. · Washington DC 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Message Analysis

- Sender: Internal Revenue Service

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- govDelivery