Email

Market Confidence Wanes After OPEC+ Production Cut: Weekly Stock Market Update

| From | Irving <[email protected]> |

| Subject | Market Confidence Wanes After OPEC+ Production Cut: Weekly Stock Market Update |

| Date | April 10, 2023 2:03 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Good morning,

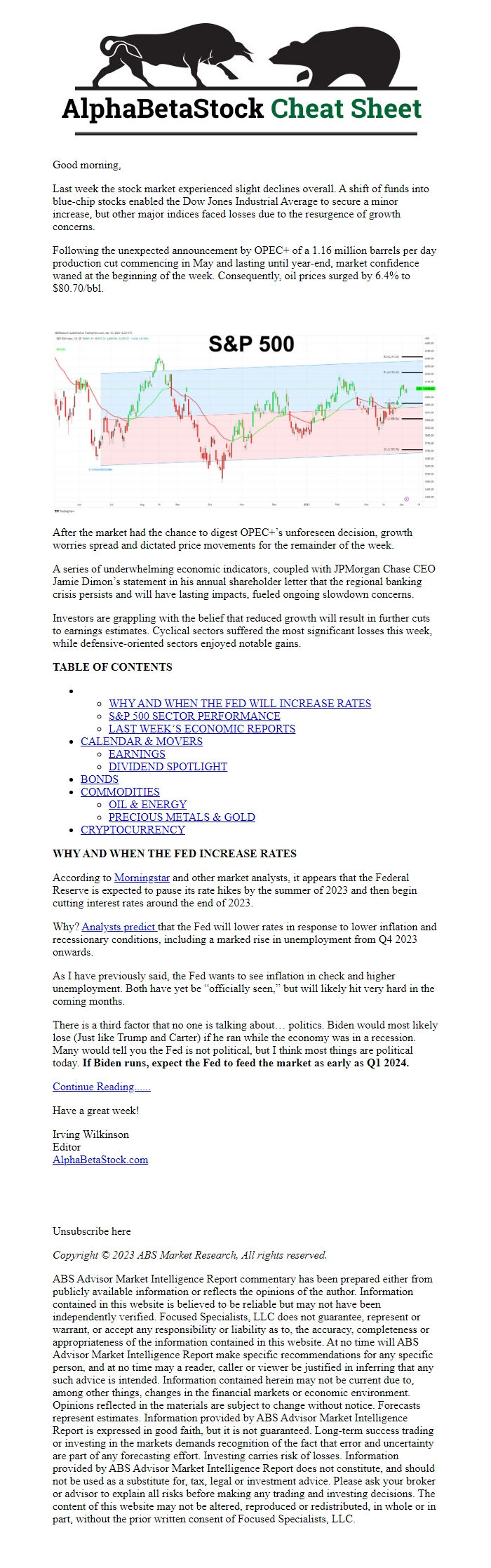

The S&P 500 had a great week, hanging out above its 50-day moving average and breaking through the 4,100 mark by Friday. We saw the significant indices playing it cool early on in the week, though, as folks like us kept an eye on the developments in the banking world, including that two-day Congressional hearing about the SIVB bank fiasco.

Table of Contents

Last Week’s Economic Reports

CALENDAR & MOVERS

Earnings

Dividend Spotlight

BONDS

COMMODITIES

OIL & ENERGY

PRECIOUS METALS & GOLD

CRYPTOCURRENCY

The good news came when we learned that First Citizens Bancshares (FCNCA) would be scooping up some of Silicon Valley Bank’s assets. Bloomberg reported authorities might expand the emergency lending facility for banks, giving First Republic Bank (FRC) some extra time to beef up its balance sheet.

However, bank stocks still felt the heat, especially after FDIC Chairman Michael Barr mentioned that more regulation and higher capital and liquidity standards are likely for big firms.

Despite all that, the S&P 500 financial sector managed to rise 3.7% this week, although it took a 6.1% dip in Q1. A chunk of this week’s gains came from the semiconductor scene, with the PHLX Semiconductor Index jumping 3.5% for the week and a whopping 27.6% for the quarter.

Investors were initially excited about Micron’s (MU) earnings, but they backed off on Friday due to rumors of Chinese regulators poking around MU products for cybersecurity reasons.

To wrap it up, all 11 S&P 500 sectors saw gains this week! Energy (+6.2%), consumer discretionary (+5.6%), and real estate (+5.2%) were the big winners, while communication services (+1.5%) and health care (+1.8%) still managed to make modest gains. Cheers to a solid week in the market!

Continue Reading......

Have a great week!

Irving Wilkinson

Editor

AlphaBetaStock.com

Unsubscribe here

Copyright © 2023 ABS Market Research, All rights reserved.

ABS Advisor Market Intelligence Report commentary has been prepared either from publicly available information or reflects the opinions of the author. Information contained in this website is believed to be reliable but may not have been independently verified. Focused Specialists, LLC does not guaranty, represent or warrant, or accept any responsibility or liability as to, the accuracy, completeness or appropriateness of the information contained in this website. At no time will ABS Advisor Market Intelligence Report make specific recommendations for any specific person, and at no time may a reader, caller or viewer be justified in inferring that any such advice is intended. Information contained herein may not be current due to, among other things, changes in the financial markets or economic environment. Opinions reflected in the materials are subject to change without notice. Forecasts represent estimates. Information provided by ABS Advisor Market Intelligence Report is expressed in good faith, but it is not guaranteed. Long-term success trading or investing in the markets demands recognition of the fact that error and uncertainty are part of any forecasting effort. Investing carries risk of losses. Information provided by ABS Advisor Market Intelligence Report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. Please ask your broker or your advisor to explain all risks to you before making any trading and investing decisions. The content of this website may not be altered, reproduced or redistributed, in whole or in part, without the prior written consent of Focused Specialists, LLC.

The S&P 500 had a great week, hanging out above its 50-day moving average and breaking through the 4,100 mark by Friday. We saw the significant indices playing it cool early on in the week, though, as folks like us kept an eye on the developments in the banking world, including that two-day Congressional hearing about the SIVB bank fiasco.

Table of Contents

Last Week’s Economic Reports

CALENDAR & MOVERS

Earnings

Dividend Spotlight

BONDS

COMMODITIES

OIL & ENERGY

PRECIOUS METALS & GOLD

CRYPTOCURRENCY

The good news came when we learned that First Citizens Bancshares (FCNCA) would be scooping up some of Silicon Valley Bank’s assets. Bloomberg reported authorities might expand the emergency lending facility for banks, giving First Republic Bank (FRC) some extra time to beef up its balance sheet.

However, bank stocks still felt the heat, especially after FDIC Chairman Michael Barr mentioned that more regulation and higher capital and liquidity standards are likely for big firms.

Despite all that, the S&P 500 financial sector managed to rise 3.7% this week, although it took a 6.1% dip in Q1. A chunk of this week’s gains came from the semiconductor scene, with the PHLX Semiconductor Index jumping 3.5% for the week and a whopping 27.6% for the quarter.

Investors were initially excited about Micron’s (MU) earnings, but they backed off on Friday due to rumors of Chinese regulators poking around MU products for cybersecurity reasons.

To wrap it up, all 11 S&P 500 sectors saw gains this week! Energy (+6.2%), consumer discretionary (+5.6%), and real estate (+5.2%) were the big winners, while communication services (+1.5%) and health care (+1.8%) still managed to make modest gains. Cheers to a solid week in the market!

Continue Reading......

Have a great week!

Irving Wilkinson

Editor

AlphaBetaStock.com

Unsubscribe here

Copyright © 2023 ABS Market Research, All rights reserved.

ABS Advisor Market Intelligence Report commentary has been prepared either from publicly available information or reflects the opinions of the author. Information contained in this website is believed to be reliable but may not have been independently verified. Focused Specialists, LLC does not guaranty, represent or warrant, or accept any responsibility or liability as to, the accuracy, completeness or appropriateness of the information contained in this website. At no time will ABS Advisor Market Intelligence Report make specific recommendations for any specific person, and at no time may a reader, caller or viewer be justified in inferring that any such advice is intended. Information contained herein may not be current due to, among other things, changes in the financial markets or economic environment. Opinions reflected in the materials are subject to change without notice. Forecasts represent estimates. Information provided by ABS Advisor Market Intelligence Report is expressed in good faith, but it is not guaranteed. Long-term success trading or investing in the markets demands recognition of the fact that error and uncertainty are part of any forecasting effort. Investing carries risk of losses. Information provided by ABS Advisor Market Intelligence Report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. Please ask your broker or your advisor to explain all risks to you before making any trading and investing decisions. The content of this website may not be altered, reproduced or redistributed, in whole or in part, without the prior written consent of Focused Specialists, LLC.

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a