| From | Minnesota Department of Revenue <[email protected]> |

| Subject | Tax Professional Tip #14 – Retirees and senior citizens |

| Date | April 6, 2023 6:13 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Tax professionals

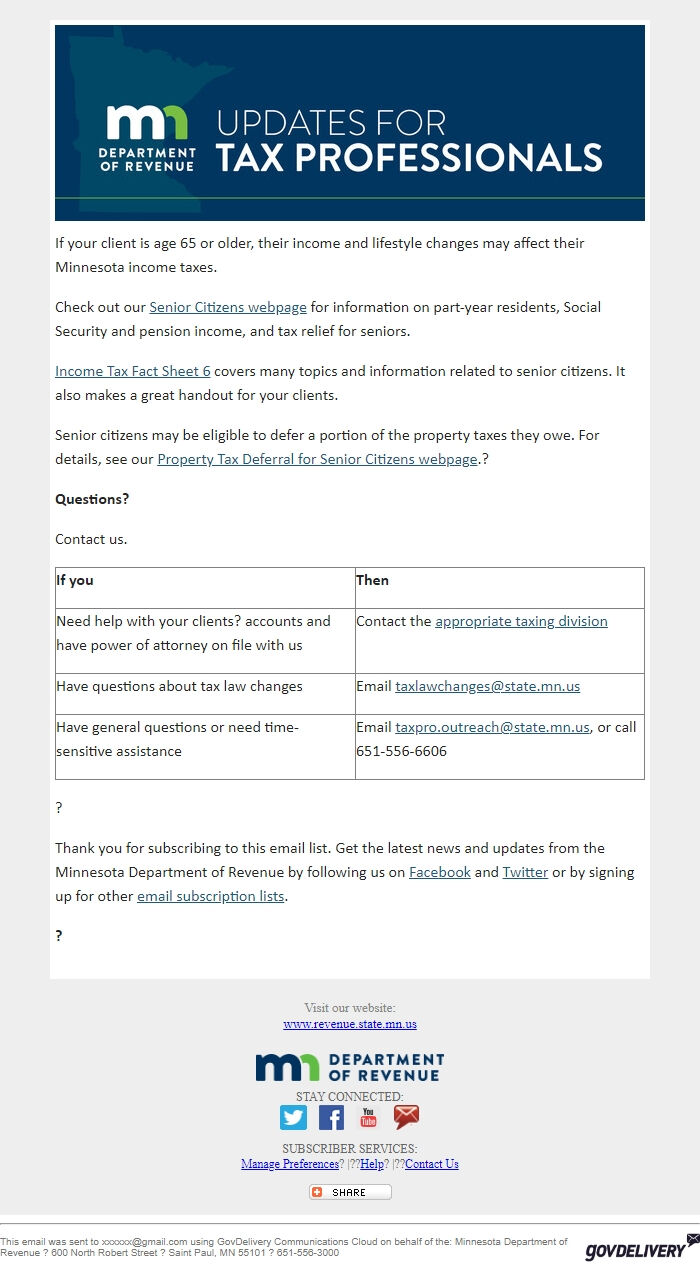

If your client is age 65 or older, their income and lifestyle changes may affect their Minnesota income taxes.

Check out our Senior Citizens webpage [ [link removed] ] for information on part-year residents, Social Security and pension income, and tax relief for seniors.

Income Tax Fact Sheet 6 [ [link removed] ] covers many topics and information related to senior citizens. It also makes a great handout for your clients.

Senior citizens may be eligible to defer a portion of the property taxes they owe. For details, see our Property Tax Deferral for Senior Citizens webpage [ [link removed] ].?

*Questions?*

Contact us.

*If you*

*Then*

Need help with your clients? accounts and have power of attorney on file with us

Contact the appropriate taxing division [ [link removed] ]

Have questions about tax law changes

Email [email protected]

Have general questions or need time-sensitive assistance

Email [email protected], or call 651-556-6606

?

Thank you for subscribing to this email list. Get the latest news and updates from the Minnesota Department of Revenue by following us on Facebook [ [link removed] ] and Twitter [ [link removed] ] or by signing up for other email subscription lists [ [link removed] ].

*?*

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ]? |??Help [ [link removed] ]? |??Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue ? 600 North Robert Street ? Saint Paul, MN 55101 ? 651-556-3000 GovDelivery logo [ [link removed] ]

If your client is age 65 or older, their income and lifestyle changes may affect their Minnesota income taxes.

Check out our Senior Citizens webpage [ [link removed] ] for information on part-year residents, Social Security and pension income, and tax relief for seniors.

Income Tax Fact Sheet 6 [ [link removed] ] covers many topics and information related to senior citizens. It also makes a great handout for your clients.

Senior citizens may be eligible to defer a portion of the property taxes they owe. For details, see our Property Tax Deferral for Senior Citizens webpage [ [link removed] ].?

*Questions?*

Contact us.

*If you*

*Then*

Need help with your clients? accounts and have power of attorney on file with us

Contact the appropriate taxing division [ [link removed] ]

Have questions about tax law changes

Email [email protected]

Have general questions or need time-sensitive assistance

Email [email protected], or call 651-556-6606

?

Thank you for subscribing to this email list. Get the latest news and updates from the Minnesota Department of Revenue by following us on Facebook [ [link removed] ] and Twitter [ [link removed] ] or by signing up for other email subscription lists [ [link removed] ].

*?*

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ]? |??Help [ [link removed] ]? |??Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue ? 600 North Robert Street ? Saint Paul, MN 55101 ? 651-556-3000 GovDelivery logo [ [link removed] ]

Message Analysis

- Sender: Minnesota Department of Revenue

- Political Party: n/a

- Country: United States

- State/Locality: Minnesota

- Office: n/a

-

Email Providers:

- govDelivery